Goldman Sachs is certainly bullish on the US economy and the consequent US dollar strength.

They see more “glory days” for the greenback and set targets for EUR/USD and USD/JPY:

Here is their view, courtesy of eFXnews:

In its last ‘Global Economics Weekly’ note for this year, Goldman Sachs makes the case for a stronger USD in 2015 calling the current episode of USD strength ‘glory days’, and advising clients to stay strategically bullish on the greenback next year. The following are the key points in GS’ note along with its latest foretastes for EUR/USD and USD/JPY.

USD strength to extend:

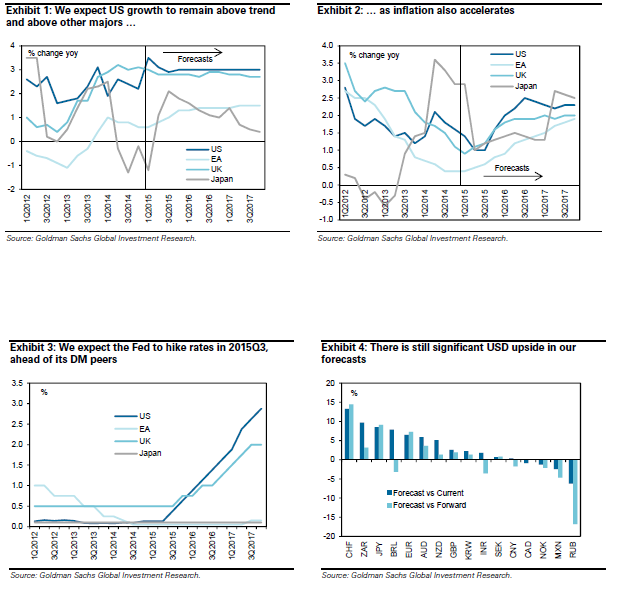

“The expectation that USD strength will extend remains a core element of our macro and market views. While the real trade-weighted USD is now at its strongest since 2009, the move is still quite modest when viewed in the context of real USD moves in the post-Bretton Woods era,” GS clarifies.

Different USD drivers in different decades:

“Looking back at previous episodes of USD strength (the 1980s and 1990s), we try to identify what has driven the Dollar higher in the past, with an eye to understanding what may be driving the Dollar higher currently. While neither historical analogy is exactly right, elements of both analogies currently seem to be in play,” GS adds.

Current US exceptionalism is, in good part, relative:

“Current US exceptionalism is, in good part, relative. In terms of both policy outcomes and growth outcomes, expectations for the US are not particularly dramatic. We do not expect a 1980s-type sea change in Fed behaviour, nor do we expect a 1990s-type productivity boost. But the gradual tightening in monetary policy, say, and the expected steady above-trend growth patch in the US are set against other DMs, where policy is turning accommodative and growth outcomes remain below-trend and continue to slip, ought to sustain USD strength,” GS argues.

EUR/USD, USD/JPY Forecasts:

For end-2015, GS targets EUR/USD at 1.15, and USD/JPY at 130.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.