The Reserve Bank of New Zealand would certainly prefer a weaker value of the New Zealand dollar, but all market forces are pushing NZD/USD higher. With the pair just dipping from the highs, do we have a buy opportunity?

Here are the 3 forces supporting a stronger NZD/USD:

- New Zealand GDP: The economy grew by 3.8% y/y in the first quarter of the year. While q/q growth was only 1% instead of 1.2% expected, the upwards revisions to previous data show very strong growth that can be envied by many countries. Even though we are already getting closer to the second quarter, the data is very relevant in the considerations of the RBNZ.

- Higher rate hike expectations: Analysts at various banks such as Deutsche Bank and Citi now sees a rate hike in July as imminent. It it not only the result of the stronger GDP, but also of the bullishness coming out from the RBNZ last time and the strong NZ labor market.

- Dovish Yellen: The stronger than expected inflation numbers in the US were considered by Fed Chair Janet Yellen as “noisy”. All in all, Yellen and her colleagues did not seem to be in a rush to lift the interest rates any time soon. This dovishness put downward pressure on the USD and also aided in pushing NZD/USD higher.

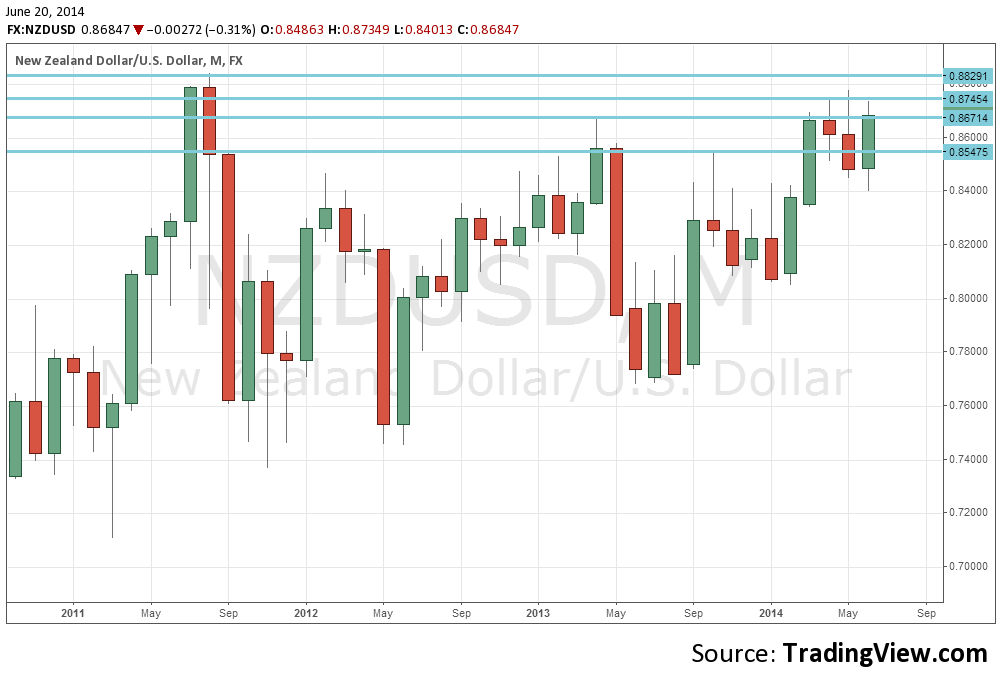

NZD/USD is higher, but struggling to hold above 0.87. Further resistance appears at 0.8745 and 0.8770. The all important level is the multi-year high of 0.8842.

Here is the recent chart:

For more, see the NZDUSD forecast.