September has been a good month for the British Pound against both the U.S. dollar and euro. For the most part, each significant U.K. economic release has had either a solid beat or at the very least a positive revision to a prior reading. The first week of September saw Manufacturing, Construction and Services PMI come in better than their forecasts. This week, the labor market saw the number of unemployed in the U.K. for the month of August fall by 32,000. Overall, employment in the U.K. is up 80,000 on the quarter and 275,000 for the year.

Even though the positive news is creating expectations for the U.K. economy to improve faster than expected, the central bank will maintain their benchmark rate at 0.5% until unemployment improves by 0.7% to the key 7.0% level, which currently is expected to occur around the middle of 2016. With inflation maintaining its downtrend, now at 2.8%, and possibly poised to hit the Bank of England’s target of 2.0% next year, traders should not be surprised that inflation concerns will ease as long as we don’t see a sudden surge in oil prices and CPI remains below 3.0%.

Bank of England Governor Mark Carney will eventually be able to show his true hawkish bias once the economy is stronger, which will probably take a couple of years, but until then, we should expect the bank’s stimulus to remain in place and see the bank stand by its forward guidance stance.

With the U.S. dollar taking an overall beating for this month, the September taper may eventually finally help it find a bid so, we will shy away from a long GBPUSD stance and focus on a short EURGBP bias.

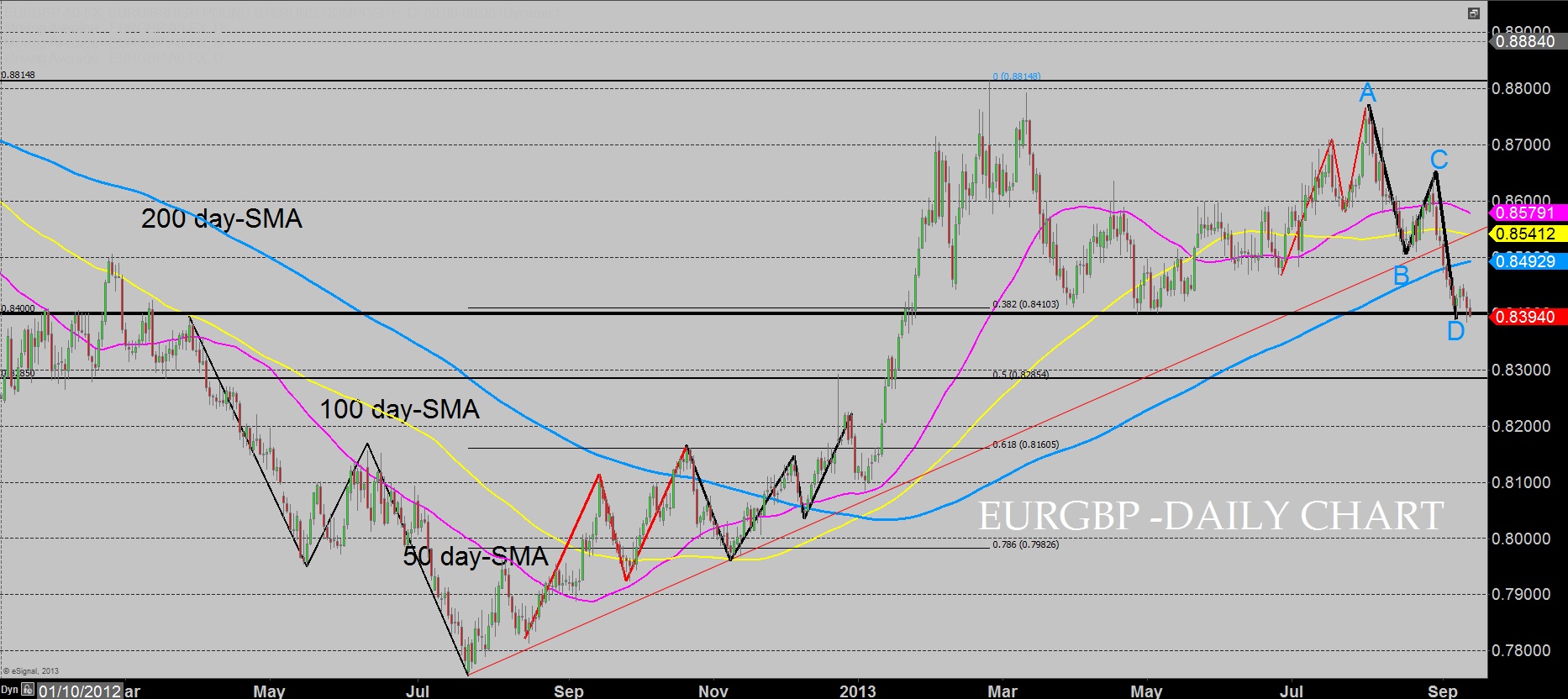

Price action on the EURGBP daily chart is currently residing on critical support near the .8400 handle. A potential bullish ABCD may be forming starting from August 1st. On September 6th, price initially respected the 161.8% Fibonacci level of the B to C leg, but now downside momentum has taken out the lows of .8391. If we see price have a daily close below that key level, a continuation pattern may target the .8300 level which is just above the 50.0% retracement of 2012 low to 2013 high move. A bearish stance will remain in place for the euro as long as we do not see price have a close above 8487 (200 day SMA).