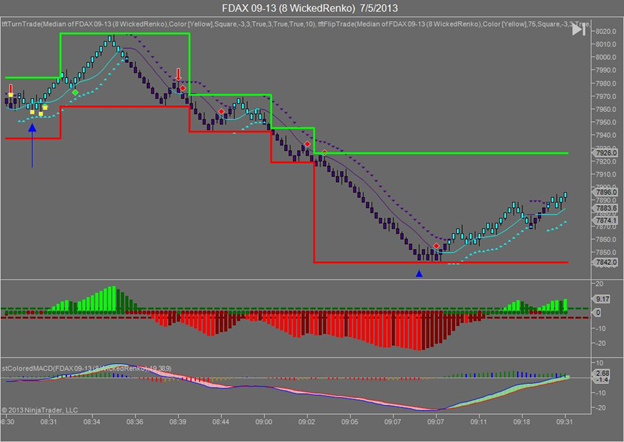

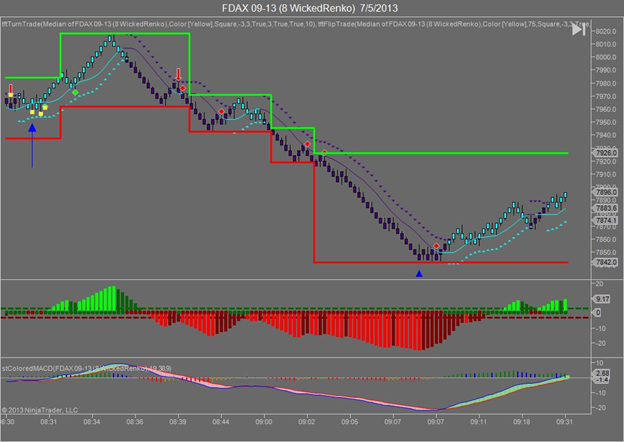

On Friday, July 5th the entire global markets were waiting for the one major economic report to be issued on that day; this being the payroll report. Well the report came out at 8:30 AM EST and showed a gain of 195,000 which was far better than was expected that being 163,000. Well on Friday the markets in the US went wild and the Dow gained 147 points on a day that was not supposed to be a heavy trading day due to the 4th of July holiday on Thursday. One key aspect of the report that was overlooked in the bedlam of buying was the unemployment rate; which held at 7.6%. What this tells me is that the United States created 195,000 new jobs but also lost as many if not more due to either layoffs or new people entering the workforce. Whereas we can argue that each year around this time of year it’s expected that new people will enter the workforce (after all wasn’t last month June and didn’t a number of people graduate?). The fact remains that the US economy isn’t creating a number of net new jobs to keep up with population growth. Whereas in the US virtually everyone was popping the champagne cork saying “see, there’s no job problem in the US” other parts of the Global Economy weren’t so easily fooled by these numbers. Case-in-point:  Chart courtesy of Trend Following Trades (www.trendfollowing trades.com) The above chart shows the German FDAX futures contract on July 5th. The 1st blue arrow shows what happened at 8:30 AM EST when the report came out. The 2nd arrow shows what happened after 9 AM. The fact is the FDAX closed down as did the FTSE, CAC and every other European exchange. They weren’t so easily fooled. Of course everyone in the US is now also saying “well it’s time to taper”. Not so fast. The unemployment rate has a long way to go to hit 6.5% which is the target whereby the Federal Reserve will evaluate the FFR (Federal Funds Rate) and then decide. Want more proof? This article provides more evidence. Ever since the last FOMC meeting when Bernanke spoke and held a press conference, the entire global community has baked in QE tapering as early as September yet Bernanke never said this. The Federal Reserve’s top “A” players have also reiterated this as well. What makes matters worse is when you have lower level FOMC members publicly stating that it could happen. This occurred on Friday, June 28th when a virtually unknown FOMC member (Stern) publicly stated such. Since when does the press and institutionals put words into the Fed’s mouth? Clearly they want rate hikes as it will increase their wealth. But know this, ever since that press conference the Dow has not regained parity and only time will tell if this remains the case. But this is what happens when perception become reality….

Chart courtesy of Trend Following Trades (www.trendfollowing trades.com) The above chart shows the German FDAX futures contract on July 5th. The 1st blue arrow shows what happened at 8:30 AM EST when the report came out. The 2nd arrow shows what happened after 9 AM. The fact is the FDAX closed down as did the FTSE, CAC and every other European exchange. They weren’t so easily fooled. Of course everyone in the US is now also saying “well it’s time to taper”. Not so fast. The unemployment rate has a long way to go to hit 6.5% which is the target whereby the Federal Reserve will evaluate the FFR (Federal Funds Rate) and then decide. Want more proof? This article provides more evidence. Ever since the last FOMC meeting when Bernanke spoke and held a press conference, the entire global community has baked in QE tapering as early as September yet Bernanke never said this. The Federal Reserve’s top “A” players have also reiterated this as well. What makes matters worse is when you have lower level FOMC members publicly stating that it could happen. This occurred on Friday, June 28th when a virtually unknown FOMC member (Stern) publicly stated such. Since when does the press and institutionals put words into the Fed’s mouth? Clearly they want rate hikes as it will increase their wealth. But know this, ever since that press conference the Dow has not regained parity and only time will tell if this remains the case. But this is what happens when perception become reality….

“Good” Jobs Report?