Greece is close to leaving the euro-zone in a process that is accelerating rapidly. This rare event, even if highly anticipated, is expected to trigger high volatility and provide trading opportunities.

Here is an explanation about the background, when can it be expected, how markets are likely to react and two ways to trade it with EUR/USD.

Why it is imminent

After coalition talks failed, Greece appointed a caretaker government and awaits elections on June 17th. This round will actually be a run off between mainstream pro bailout / austerity parties and anti-austerity ones. Or if you wish – a referendum, such as the one suggested by former PM Papandreou in October.

SYRIZA, that came in second, is now leading in the polls, thanks to its charismatic leader Alexis Tsipras and 5 years of recession, which some define as a depression. It calls for abolishing the bailout and defaulting on all the debt – a move that will likely lead to leaving the euro.

A month is a long time, and with most Greeks preferring the euro membership, things might change. Yet time doesn’t freeze and the wheels are already in motion:

- Bank jog / run: Greeks are withdrawing money from their banks. This still isn’t a massive panic, but when the media magnifies these moves, the snowball could roll and it could turn into a panic.

- ECB blocking small Greek banks: The European central bank already cut off small banks that don’t comply. The bigger ones could be next. This is what can lead Greece to leaving the euro and creating its old / new currency – the drachma.

- Tax Run: The political uncertainty is causing some Greeks to defer their tax payments. In addition, the electricity company responsible for collecting property taxes, isn’t doing it, with a silent consent from the government. This is part of the austerity measures, and the lack of taxes means more pressure on Greece’s coffers.

- Privatization freeze: Greece was supposed to undergo a rapid process of privatization in order to generate more income. This is frozen now – more pressure on the coffers.

- Open talk: The once taboo subject of a Grexit is now spoken out loudly: it’s not only the passive agrresive German finance minister Schäuble, but also members of the ECB, the IMF, head of the Eurogroup Jean-Claude Juncker (which rejects it), and others. Some are already saying that preparations are underway. It will not be surprising if also Greece is already secretly printing drachmas.

When will it happen and what can be expected

It’s hard to say when exactly it will happen. Such a move should be prepared ahead of time and triggered fast, in order to make it swift. If the “bank jog” turns into a panic bank run, this could happen sooner.

Such a move could also wait for after the general elections on June 17th, or even well after it, if the situation stabilizes and more preparations are necessary.

A more certain assumption can be made about the time of the week: during the weekend. After making the announcement, there will be a withdrawal freeze (or limit), accompanied with a possible bank holiday of several days in Greece. This time will be used to prepare the public, change the money in the banks, etc.

A bank holiday will not happen in foreign exchange markets when trading resumes on Sunday evening (European time).

Policymakers are probably working on a contingency plan right now – a plan that will be presented when this happens.

Expected Market Reaction

Everybody is talking about the Grexit, yet when it eventually happens, there will still be a shock. This is uncharted territory – a member never left the euro-zone. A lot of uncertainty will be left about:

- Actual devaluation of the drachma against the euro – ballpark estimations are 50-70% but nobody knows. This has a strong impact on the actual costs of the Grexit.

- State of French and German banks after this move. They are the most exposed entities to Greek debt, yet some have already begun writing off this debt.

- Actions of the ECB and politicians as a reaction to this move, and if these actions will be sufficient.

- Contagion effect: The “domino effect” is the biggest fear. While Greece owes a lot of money to other European countries, its economy is only 2.2% of the euro-zone’s economy. Italy and Spain are much bigger. Spain and its banks are already struggling and the credit crunch is felt in some areas of the economy.

So, a huge Sunday gap is likely. Yet as always, markets tend to overreact and make extreme moves and tend to correct. Once the picture becomes more clear, markets will stabilize.

Two Ways to Trade It

The Grexit can trigger huge moves, similar to the ones seen after the collapse of Lehman Brothers. This provides an opportunity but also poses risk.

- Bet on the exit: I am using the word “bet” as this event isn’t 100% and the timing is very hard to guess. This tactic means going short on the euro on Friday. Then, as markets open and the euro falls, cover the position rather fast. As iolent corrections can happen. Even if the gap isn’t closed (most likely, and will serve as a bearish sign) it will be hard to tell how the currency will move in the wake of the European session, when liquidity rises and the picture regarding the Grexit becomes clearer.

- Trade the Exit: This is a “safer” tactic, but yet again, a Grexit is uncharted territory. The best way is to go with the trend, going short very early. The gap will already be behind us, but some falls are certainly possible. Another, less recommended tactic is to try and pick the bottom and go long – catching the violent correction. This will likely be short lived.

Charts

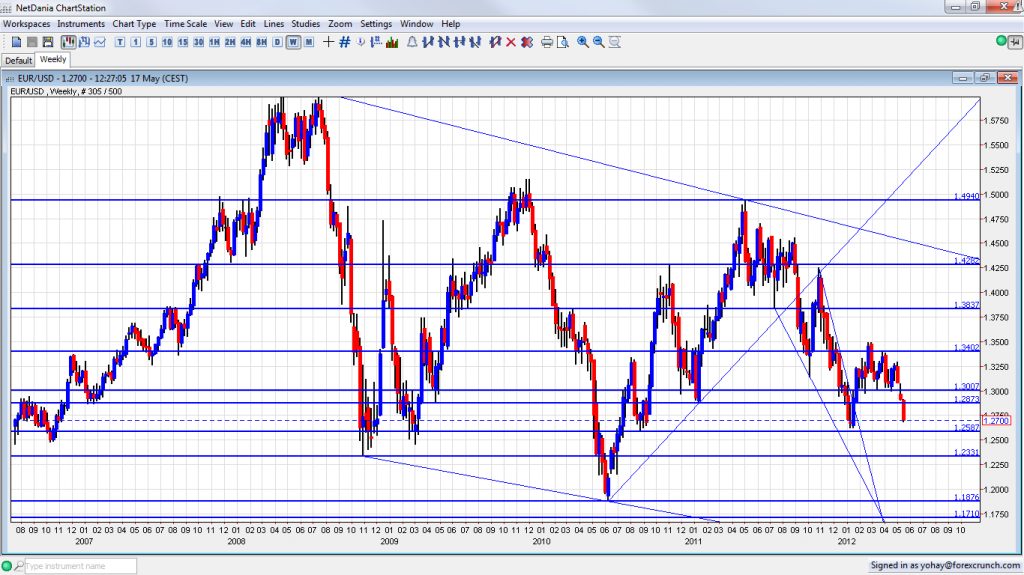

Here is a weekly chart of the euro, with some key “big picture” lines:

EUR USD Weekly Chart – Click image to enlarge

About the lines below:

1.2587 is important to support below after providing support during 2010. It will be attacked if the 2012 low of 1.2623 gives way. The first post-crisis bottom at 1.2330 is becoming old, but still worth mentioning.

Below 1.20, the 1.1876 bottom seen in 2010 is a very strong line. The last line is symbolic: 1.17. This the launch price of the euro in 1999.

More long term analysis appears in the monthly outlook available for free download. For more on the euro, see the EUR/USD Weekly Outlook

What do you think? Is this a tradeable event? Will you consider trading it?

Further reading

- 5 Most Predictable Currency Pairs – Q2 2012

- Greece Leaves the Euro-Zone? This Could Solve So Many Problems