EUR/USD has traded in a very frustrating range for quite some time. Will it break? The team at CIBC sees the world’s most popular currency pair grinding lower:

Here is their view, courtesy of eFXnews:

Despite the obvious concern regarding Brexit-related headwinds impacting the Eurozone economy, the ECB isn’t in a rush to ease policy further. Indeed, with little left in the toolkit and the impact of the most recent corporate purchase programme yet to work its way through the system, it makes sense to wait for evidence that the Eurozone is being materially impacted by the outcome of the UK vote before acting.

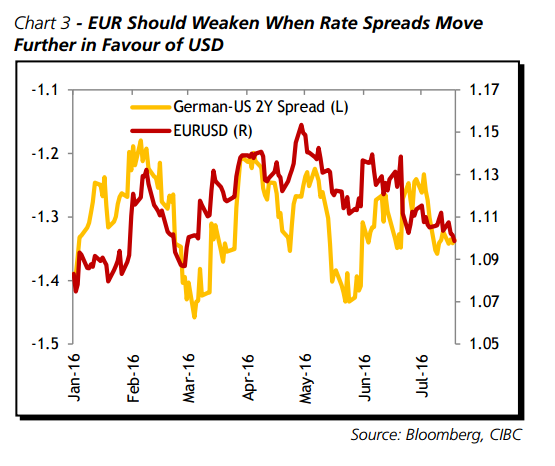

Monetary hawks like Lautenschlaeger and Weidmann remain reluctant to agree to further action. However, as we move towards the end of Q3, any signs of a Brexit-related slowdown, likely accompanied by ongoing banking sector uncertainty, could see US/ EU rate spreads moving back towards earlier extremes, exerting downside pressure on the euro (Chart 3).

Although inflation expectations have rebounded from post-Brexit lows below 1.25%, they remain materially lower than the ECB’s target threshold and could tip the central bank into further stimulus at future meetings.

The ongoing presence of a large current account surplus and the risk of banking sector repatriation flows, to support weak balance sheets, will limit the extent of any euro depreciation.

However, we still expect EURUSD to dip to 1.06 by the end of September on the back of broad US dollar strength.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.