Over 100 days without any coronavirus case have come to an end – and the central bank is set to take note. Four new coronavirus cases broke New Zealand’s successful streak of depressing the disease and have resulted in new restrictions, especially in Auckland.

Apart from the economic fallout from new lockdown measures, the Reserve Bank of New Zealand may also take a page from its peers across the Tasman Sea. The Reserve Bank of Australia recently boosted its bond-buying scheme amid the rise in COVID-19 cases in Melbourne.

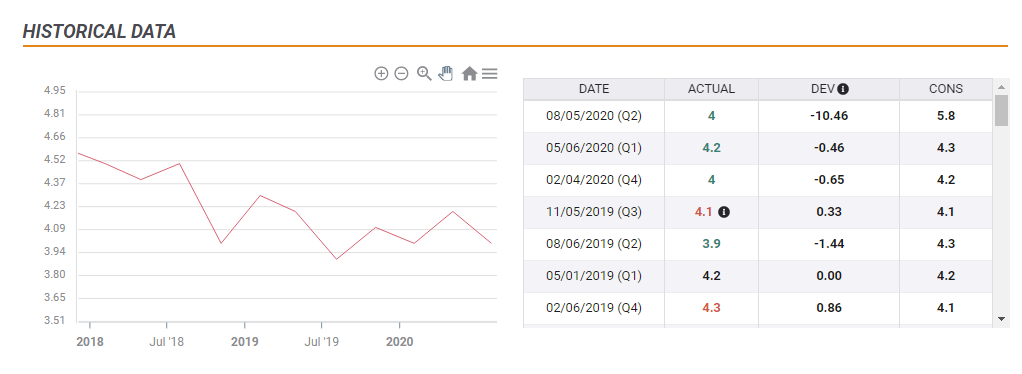

New Zealand’s economic situation remains relatively upbeat, with depressed unemployment, remaining at 4% in the second quarter of 2020:

Growing concerns, policy options, forecasts

Nevertheless, the ongoing global crisis and potential hardship from the country’s ongoing isolation may prompt preemptive steps. Adrian Orr, Governor of the Reserve Bank of New Zealand, has previously opened the door to negative interest rates and even monetary financing of the government in Wellington.

If he reiterates his willingness to set sub-zero borrowing costs, the New Zealand dollar has room to the downside – despite the relatively upbeat economic performance.

Moreover, the RBNZ’s bond-buying scheme currently stands at NZ$60 billion, and there is room to expand it. Going as far as purchasing foreign bonds – unthinkable by any central bank in pre-pandemic times – would already have a detrimental impact on the kiwi, yet remains highly unlikely.

Apart from setting rates and releasing a statement, the bank also publishes its quarterly Monetary Policy Statement – a broad report including forecasts for growth and inflation. Up-to-date estimates of growth projections could also guide the kiwi.

It is essential to note that the RBNZ’s decision comes ahead of the September 19 elections and Orr would prefer to stay out of the spotlight, refraining from bombastic statements. Nevertheless, the central bank is highly respected in New Zealand, and its outlook could rock the kiwi.

The mood around the US dollar is unstable, with investors moving from optimism regarding a vaccine and US fiscal stimulus to dismay over the deadlock in Washington and worries about the Sino-American trade deal. The bias toward the safe-haven US dollar at the time of the RBNZ’s decision will also have its impact on NZD/USD.

Conclusion

The RBNZ is set to leave rates unchanged but hint about future policy and provide new forecasts. While recent economic performance has been upbeat, headwinds to the global economy remain prevalent, potentially triggering a dovish stance that may weigh on NZD/USD.

More NZD/USD analysis:Two scenarios likely

Get the 5 most predictable currency pairs

RBNZ Preview: Ending NZD/USD’s recovery attempt? Dovish stance on QE and coronavirus may weigh