The Euro crashed yesterday against all major currencies, including the US dollar, the British pound and the Australian dollar. The reason behind the fall was the ECB interest rate decision. The European central bank decided to cut the key interest rates to new record lows at the September meeting.

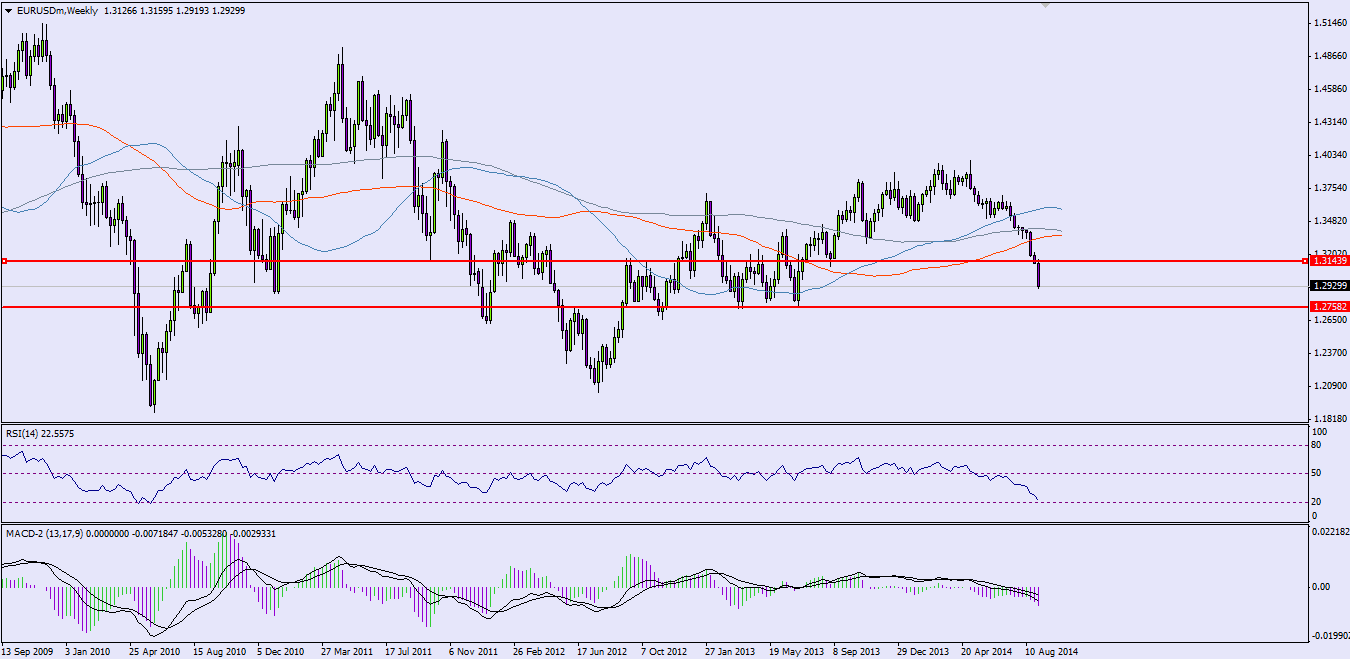

This came as a shock to the investors, as the Euro fell more than 100 pips within an hour. The ECB press conference further ignited the downside, as the ECB president Mario Draghi mentioned that the central bank will be introducing asset-backed securities and covered bonds purchases program during the next month. This did not go down well with the Euro buyers, as the EURUSD pair fell not only below the 1.30 support area, but also broke the 1.2950 support area.

The decline in the EURUSD pair was simply unstoppable, as the pair was crushed. It was a double assault, as the economic releases in the US came on the positive side. The pair traded as high as 1.3151 earlier during the London session, but fell more than 200 pips in an hour to trade below the 1.2950 level. It was a black day for the Euro longs, as they were simply outplayed by the Euro shorts.

US ISM Non-Manufacturing

Yesterday, one of the important released in the US was the ISM Non-Manufacturing Index which was released by the Institute for Supply Management (ISM). The market was expecting a minor decline of 1.2 points from 58.7 to 57.5. However,

the outcome was much higher, as the US ISM Non-Manufacturing Index registered 59.6 percent in August, 0.9 percentage point higher than the July reading of 58.7 percent.

The most important point to note from the report was that this is the 55th consecutive month of the increase in the economic activity in the non-manufacturing sector. This further boosted the US dollar, and the EURUSD pair was pressure to trade below the 1.2940 level.

US Services PMI

One of the other releases was the US services PMI which was released by Markit Economics. The report mentioned that the US services PMI fell from 60.6 to 59.7, but the service providers indicated another month of strong output and new

business gains in August, highlighting an ongoing rebound in operating conditions through the summer. This was again seen on the positive side. The US dollar overall traded higher against most major currencies after the release.

The Euro was further pressured and was seen trading lower towards the next support around the 1.2900 handle. The US dollar was simply unstoppable, as it gained heavily against the British pound too.

Technically, the EURUSD pair has no major holding support until the 1.2800 level, as the pair was unable to hold the 1.30 support area. It was a huge support, but the Euro sellers showed no respect whatsoever and took the pair below the 1.2980 level. The 1.2980 level might be seen as an immediate support on the upside, as it acted as a pivot earlier.

So, keep an eye on all the important levels friends and trade accordingly.

Guest post by Vladimir Ribakov of http://vladimirribakov.com/