The euro today fell against the US dollar during the European session following the release of weak German ZEW survey data early in the session. The EUR/USD currency pair traded at 34-month lows as the coronavirus headlines continue to dampen investor risk appetite. The EUR/USD currency pair today fell from an opening high of 1.0838 to a low of 1.0786 in the … “Euro Drops to Multi-Year Lows on Weak German ZEW Survey Data”

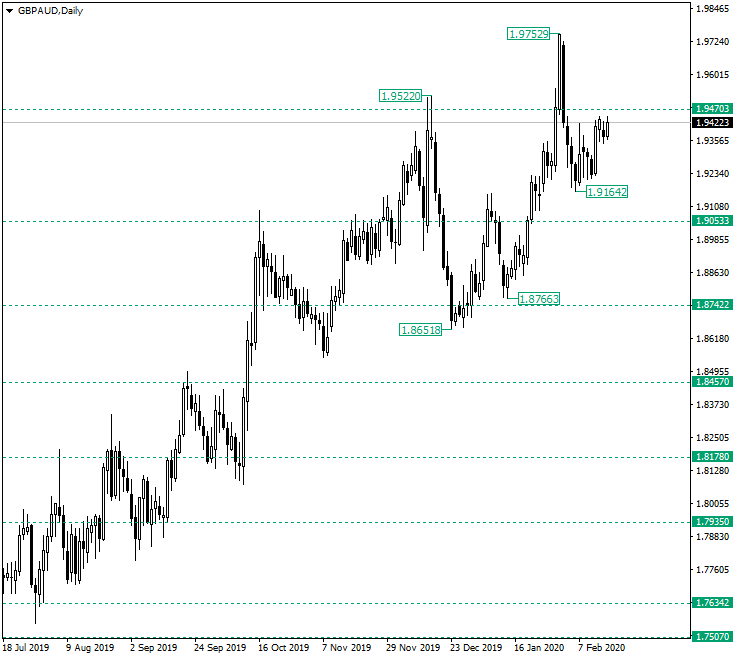

GBPAUD Could Challenge 1.9752

The Great Britain pound versus the Australian dollar currency pair seems to try climbing bigger prices. Are the bears in the search for a good spot to short from? Long-term perspective The ascending trend that began after the confirmation of 1.7634 as support, extended until the peak of 1.9752. From there, it retraced under the previous peak — of 1.9555 — and under the level of 1.9470. The fact that the price went beneath the level, can be seen by the bears … “GBPAUD Could Challenge 1.9752”

Pound Falls on Johnsonâs Brexit Comments Amid Low Liquidity

The Sterling pound today fell against the US dollar as the UK and the European Union continue to play hardball with each other ahead of the official Brexit negotiations. The GBP/USD fell for most of today’s session amid low-liquidity conditions, given that the US markets remained closed even as the country celebrates President’s Day. The … “Pound Falls on Johnsonâs Brexit Comments Amid Low Liquidity”

Chinese Yuan Gains As PBoC Cuts Rates, Hints at More Stimulus

The Chinese yuan is strengthening against the major currency rivals to kick off the trading week, buoyed by investorsâ hopes that Beijing will launch additional fiscal and monetary stimulus to protect the economy from the Wuhan coronavirus fallout. Over the last two weeks, policymakers have unveiled economic measures to limit the damage from Covid-19, and financial markets have been ebullient over the announcements. On Monday, the Peopleâs Bank of China (PBoC) lowered … “Chinese Yuan Gains As PBoC Cuts Rates, Hints at More Stimulus”

Japanese Yen Struggles to Hold Ground After Awful GDP Print

The Japanese yen was vulnerable today after the release of an awful report on the country’s gross domestic product. Furthermore, investors were moderately hopeful that China’s efforts to battle the deadly epidemic of a coronavirus will bear fruit. Nevertheless, the yen did not perform that bad considering the circumstances, even managing to gain on some of its rivals. Japan’s Cabinet Office reported that GDP dropped by 1.6% in the fourth quarter of 2020, much … “Japanese Yen Struggles to Hold Ground After Awful GDP Print”

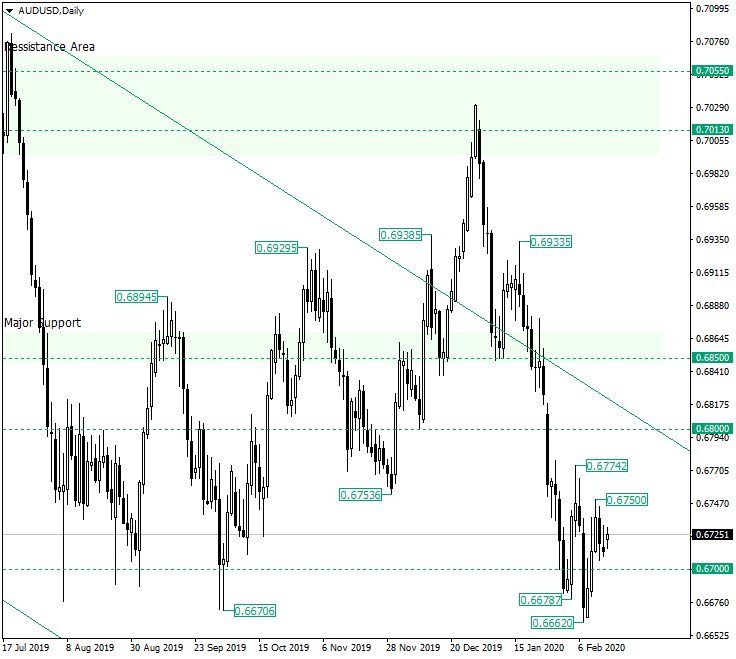

Are the Bulls Really in Control of 0.6700 on AUDUSD?

The Australian dollar versus the US dollar currency pair seems to be part of both bullish and bearish sides. But on which side is it, actually? Long-term perspective After printing the head and shoulders pattern marked by the highs of 0.6938 and 0.6933, respectively, the price dropped under the major support of 0.6850. By doing so, it also re-entered the descending channel, which fueled the decline even more. As a result, the price reached the area of the 0.6700 … “Are the Bulls Really in Control of 0.6700 on AUDUSD?”

AUD/USD: Coronavirus not over, Australian labor data awaited

AUD/USD has been on the rise amid a calmer market mood. Australia’s jobs report and further coronavirus headlines are set to dominate trading. Mid-February’s daily chart is painting a bullish picture. The FX Poll is showing short-term drop and higher levels later on. The Australian dollar has benefited from receding fears about the coronavirus and … “AUD/USD: Coronavirus not over, Australian labor data awaited”

US Dollar Slips on Mixed Data, Coronavirus Uncertainty

The US dollar is falling against multiple currency competitors to finish the trading week. The greenback could not find a concrete direction on Friday as the key economic reports were mixed. There is still a great deal of uncertainty in global financial markets surrounding the coronavirus, which was recently named Covid-19 by the World Health Organization (WHO). Despite the hiccup at the end of the trading week, the US dollar is still having an incredible start … “US Dollar Slips on Mixed Data, Coronavirus Uncertainty”

After the reshuffle, GBP/USD now faces the hard data

GBP/USD has been able to overcome Brexit concerns and move higher after the cabinet reshuffle. A busy week including inflation, employment, retail sales, and PMIs awaits pound traders. Mid-February’s daily chart is more bullish. but points to a critical double-top. The FX Poll is showing a bullish bias on all timeframes. Keep calm and carry … “After the reshuffle, GBP/USD now faces the hard data”

Macron Gap may result in 50-100 pip fall in EUR/USD

EUR/USD has been extending its slide amid economic divergence and other factors. It is nearing the chart gap created by French President Macron’s victory in April 2017. The slow grind lower may turn into an avalanche. Is EUR/USD moving too slowly? The world’s most popular currency pair has been stuck for months and even when … “Macron Gap may result in 50-100 pip fall in EUR/USD”