Alistair Darling’s pounded the Pound once again. The “supertax” on bank bonuses distracted the markets for a short time, until the pre-budget was fully digested. The gloomy picture drawn in the report sent the Pound down across the board, a day before the rate decision.

The Distraction

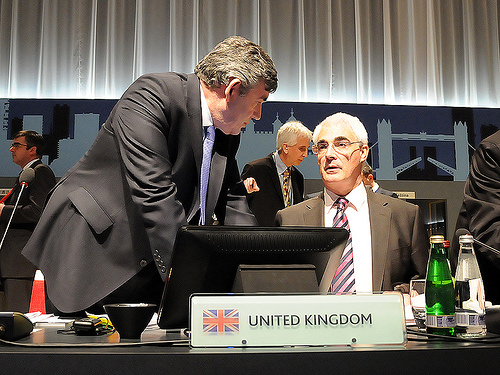

Alistair Darling, the Chancellor of the Exchequer in Britain (or treasury minister if you wish), went to parliament to present the annual budget for 2010. The big news was the news “supertax” on bank bonuses – a 50% taxation on bonuses above 25,000 pounds.

This announcement addresses public anger about the huge bonuses taken by bank managers. The public rage continues also across the Atlantic, where senior American bankers take home a lot of bonus money while their institution begs for taxpayers money.

While this announcement easily caught the ears of the press, and is interesting, this super tax isn’t that important for forex traders.

Darling on the British economy and debt

Darling also addressed the whole economy. The first headline was that the growth forecast for 2010 would remain 1-1.5%. No change means no news, right? This was followed by a forecast for 2011 – 3.75% growth rate. Wonderful! But Darling may be out of office by then. Elections are due in Britain next year, and he may need to search for another job, even if the Labor Party forms the next government.

The news is in the near future: Darling downgraded the forecast for 2009, which is about to end – a contraction of 4.75% is the new forecast, replacing the 3.75% forecast. This was one weight on the Pound.

The second weight on the Pound is the budget. He didn’t address the growing deficit problem. It’s hard to do that on an election year. The market expected him to address this issue and spend less. More spending means a devalued British Pound.

Market Reaction – Pound is pounded, but slowly

GBP/USD fell from 1.6350 to a 1.6223 at the time of writing. It took some time for this move happen, about three hours. Below 1.6260, the next support line for cable is at 1.6110.

GBP/JPY fell from 144 to 1.42.50. GBP/CHF fell from 1.6775 to 1.6634. EUR/GBP rose from 0.9010 to 0.9085. This is especially notable since the Euro also has it’s own troubles: Greece and Spain are both suffering.

Tomorrow, the focus moves to Mervyn King, governor of the BoE. More about the rate decision and a deeper technical analysis can be found in the British Pound forecast.

Trade together with Currensee