Loonie is finally getting a boost today, ending a rather lackluster year on a high note. Canadian dollar has seen its strength leak away over the course of 2013, and many believe that parity with the US dollar is gone for quite some time. Canadian dollar started the year off at right around parity with the US dollar, but that has since changed. Volatile oil prices haven’t … “Loonie Gets Boost on Final Day of 2013”

Month: December 2013

Economic Expectations Boost the UK Pound

Economic expectations are helping the UK pound today, especially against the euro. The pound is seeing success as Forex traders and analysts look to 2014 for continued improvement in the UK economy. Many expect good news for the housing sector, and that is expected to form the cornerstone of economic recovery. During 2013, the sterling appreciated against 13 of 16 major counterparts. Today, the UK pound is at a three-week high against the euro. Even though … “Economic Expectations Boost the UK Pound”

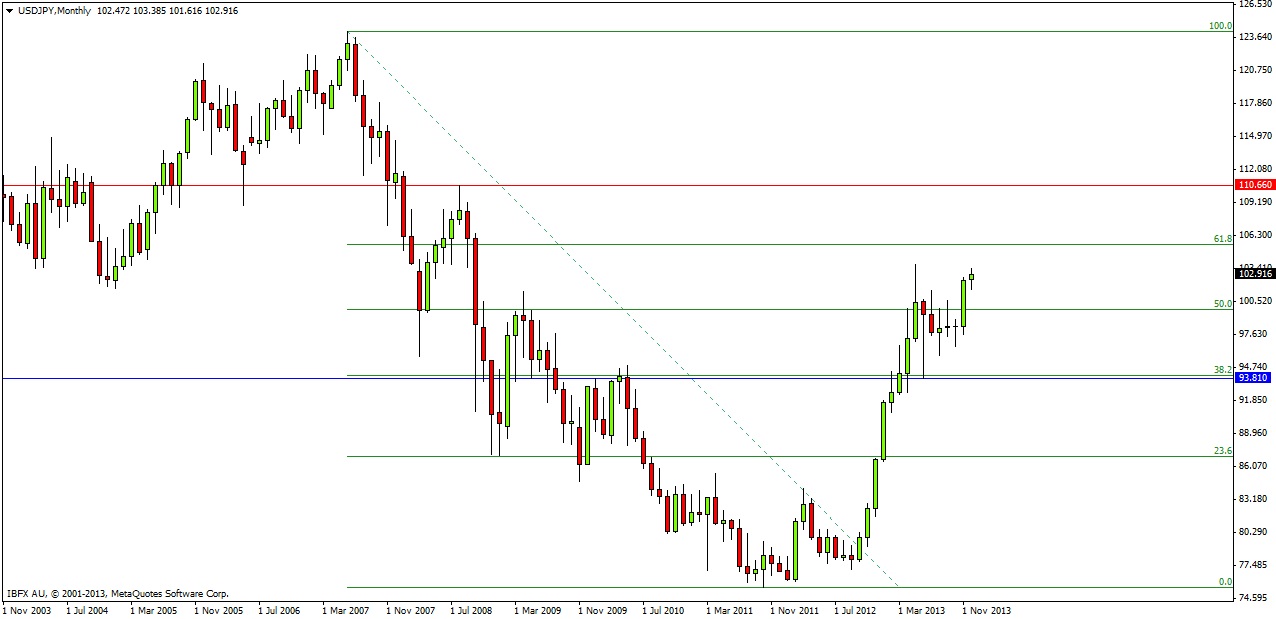

USD/JPY Forecast for 2014

A forecast covering a long time period such as a year should account for both technical and fundamental factors that will shape the price movements of the currency pair in question. Technical Factors Although in recent years this pair has been seen as a ranging rather than trending pair, the statistics actually show that over … “USD/JPY Forecast for 2014”

Dollar Index Down Today, But Expected to Gain on the Year

Greenback is heading lower today against most of its major counterparts. The dollar index might be up on the year, but today it’s pulling back on disappointing data and better news in other regions. US dollar is struggling today, heading mostly lower as Forex traders assess their positions at the end of the year. The dollar index is a bit lower, following recent economic data. The Institute for Supply Management released … “Dollar Index Down Today, But Expected to Gain on the Year”

Fund Repatriation and Rate Comments Help Euro

As the year draws to a close, the euro continues to gain ground against its major counterparts. Much of the help for the euro comes from comments that another rate cut isn’t likely to be needed to help keep the economy in recovery mode. However, there is also help for the euro from the fact that banks are repatriating funds. Euro zone banks are repatriating their funds as the year draws to a close. Another ECB … “Fund Repatriation and Rate Comments Help Euro”

Yen Falls to New Lows over Week

The Japanese yen continued to show great weakness during the past year even as some of news should have been supportive for the currency. It looks like policy makers have made the currency rather unattractive for investors, which actually makes it easier for the central bank to achieve its inflation target. There were quite a few positive events for the yen. Inflation accelerated, coming nearer to the 2 percent target. The economic outlook … “Yen Falls to New Lows over Week”

Yen Falls Despite Supportive Data

The Japanese yen ended Friday with losses even though macroeconomic data from Japan was very positive, making it less likely for the nation’s central bank to introduce additional monetary accommodation. Japan’s core Consumer Price Index rose 1.2 percent in November from a year ago, slightly above the consensus forecast of 1.1 percent. The Tokyo core CPI was up 0.7 percent, increasing from October’s 0.6 … “Yen Falls Despite Supportive Data”

Interest Rate Outlook Makes Loonie Close Weaker

The Canadian dollar ended Friday with losses as Canada’s central bank was not showing willingness to raise interest rates, while the US Federal Reserve has already cut its stimulus program. The Fed reduced its monthly asset purchases by $10 billion per month and US policy makers were signaling since then that additional stimulus cuts may follow. Such prospects hurt growth-related currencies. By contrast, … “Interest Rate Outlook Makes Loonie Close Weaker”

Won Rises as Exporters Convert Earnings Ahead of Year-End

The South Korean won advanced today, unharmed by the risk aversion sentiment on the Forex market, as Korea’s exporters were converting their earning into the local currency ahead of the year-end. Unlike some other Asian currencies, including the Indonesian rupiah, the won was not bothered by the risk-negative sentiment among investors. South Korean exporters were selling dollar to convert their overseas profits into the domestic currency, increasing demand for the won. There … “Won Rises as Exporters Convert Earnings Ahead of Year-End”

Rupiah Suffers from Fears of Capital Outflows & Current Account Deficit

The Indonesian rupiah fell today as the announcement of quantitative easing tapering by the US Federal Reserve spurred capital outflow from the country, leading to concerns that the nation’s current account deficit may widen. The Fed announced last week that it is starting to scale back its monetary stimulus. The announcement made investors flee risky assets, including currencies of emerging economies. The Indonesian current account has been in a deficit for two … “Rupiah Suffers from Fears of Capital Outflows & Current Account Deficit”