The Canadian dollar remains under pressure with falling oil prices. We have not reached the bottom of the barrel according to the team at Citi: Here is their view, courtesy of eFXnews: Citi analysts expect that USD/CAD may rise toward 1.4200 for the coming 0-3 months. “Since petroleum products are Canada’s major export, the persistent … “USD/CAD To Rise Toward 1.4200 – Citi”

Month: December 2015

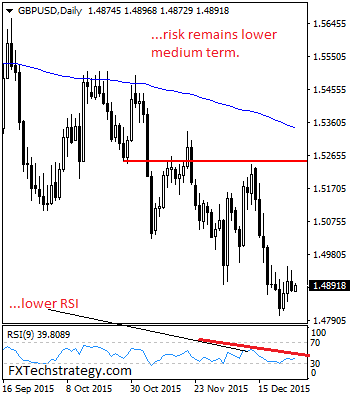

GBPUSD Faces Downside Pressure On Recovery Failure

GBPUSD: Having failed to follow through higher on the back of its Friday strength on Monday, GBPUSD faces downside pressure on recovery failure. While the 1.4949/44 zone caps any strength, we look for the pair to weaken. Support lies at the 1.4850 level where a break will turn attention to the 1.4800 level. Further down, … “GBPUSD Faces Downside Pressure On Recovery Failure”

Forex Bonuses: Pros and Cons

A regular trader would visit quite a few FX sites, like ForexCrunch, to get the the most recent market updates, learn more about possible moves of the currency pairs and find useful information to enhance his decisions. It is often possible to encounter quite a few broker advertisements that promote a certain deposit bonus campaign while browsing FX … “Forex Bonuses: Pros and Cons”

Euro Establishes Defined Range

The world of forex has had a somewhat subdued year in 2015, with most of the market’s attention being placed on only a few currencies. This ultimately shows that the market is focusing on central bank policy rather than external market events, and this creates some interesting trading implications for 2016. Most of the … “Euro Establishes Defined Range”

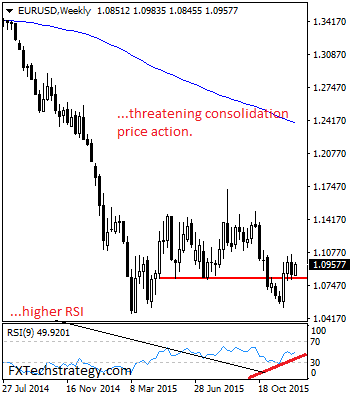

EURUSD Faces Price Consolidation Risk In The New Week

EURUSD: Having taken back almost all of its previous week losses to close higher on Friday, EURUSD faces price consolidation risk in the new week. This development if triggered could see trade between the 1.1466 and the 1.0818 range. On the downside, support resides at the 1.0900 zone. A cut through here will open the … “EURUSD Faces Price Consolidation Risk In The New Week”

Dollar Moves Lower During Week’s Thin Trade

Trading during the past week was light as traders were preparing for Christmas. This did not prevent the US dollar to move lower, sometimes noticeably, against other most-traded currencies. The first interest rate hike from the Federal Reserve in nearly a decade failed to propel the dollar higher. There could be several reasons for such behavior, but the important fact remains that the Fed’s decision was not as bullish as one … “Dollar Moves Lower During Week’s Thin Trade”

How Low Can The CAD Go? – Nomura

The Canadian dollar suffered with oil prices but didn’t really recover when they recovered. What’s next? Here is the view from Nomura: Here is their view, courtesy of eFXnews: “The Canadian dollar has depreciated significantly in recent weeks. Most of the depreciation can be linked to the further decline in oil prices and, to a … “How Low Can The CAD Go? – Nomura”

South Korean Won Gains on Dollar & Euro

The South Korean won gained against the US dollar and the euro during the current trading session with the help of domestic fundamentals that were relatively supportive to the currency. The Consumer Confidence decreased slightly to 103 in December from 106 in November, but remained in positive territory for the fifth month. South Korean GDP received a positive revision for its growth in third quarter both from the previous quarter and from the previous year. As a result, the won … “South Korean Won Gains on Dollar & Euro”

Vietnamese Dong Flat as Inflation Accelerates

The Vietnamese dong was little changed against the US dollar and fell versus the euro today after consumer inflation accelerated this month and the interbank rate of the nation’s central bank increased. Vietnam’s annual inflation accelerated to 0.6 percent in December, up from 0.34 percent in November, but was nowhere near the central bank’s target of 5 percent. Meanwhile, core inflation actually slowed to 1.69 percent this month from … “Vietnamese Dong Flat as Inflation Accelerates”

Where To Target GBP/USD, USD/JPY, EUR/USD In 2016? –

After 2015 has seen significant movements, it’s time to look to 2016, which is just around the corner. Here are the views on major pairs from Deutsche Bank: Here is their view, courtesy of eFXnews: GBP/USD: “In 2016, the GBP is likely to remain vulnerable most obviously against the USD. The pound in particular should … “Where To Target GBP/USD, USD/JPY, EUR/USD In 2016? –”