The euro was down intraday as investors were afraid that problems of Deutsche Bank may spill over the entire eurozone banking sector. Yet the currency managed to close above the opening level as fears receded. European shares went sharply higher on Friday as the situation with German’s biggest bank was improving. There were reports that the bank is close to settlement with the US Justice Department, which charged the bank … “Euro Recovers After Losses Caused by Deutsche Bank”

Month: September 2016

We Expect Clinton To Win In November, Fed To Hike

Clinton’s victory in the first debate is beginning to show in the post-debate polls. Will this lead to a victory on November 8th? Here is the view from Credit Agricole about implications for the dollar as well: Here is their view, courtesy of eFXnews: While pre-election jitters could hurt USD, we expect a Hillary Clinton win in November … “We Expect Clinton To Win In November, Fed To Hike”

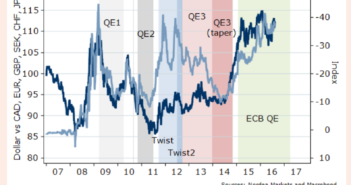

USD To Fall Another 3-4% From Current Levels – Morgan

The US dollar is looking for a new direction after the Fed left rates unchanged but hinted for a hike, and as uncertainty prevails after the first presidential debate. The team at Morgan Stanley sees downside risk for the greenback: Here is their view, courtesy of eFXnews: Flatter curve, weaker USD. We project the USD to … “USD To Fall Another 3-4% From Current Levels – Morgan”

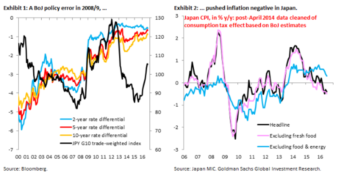

USD/JPY: This Is ‘The (Y)ENd Game’ – Goldman Sachs

The Bank of Japan said its word: targeting long-term interest rates. But what does it actually mean? The team at Goldman Sachs sees the Japanese currency coming under pressure: Here is their view, courtesy of eFXnews: We are thinking about last week’s actions from the BoJ along two dimensions. First, we continue to see the substantive … “USD/JPY: This Is ‘The (Y)ENd Game’ – Goldman Sachs”

Canadian Dollar Goes Lower After Two Days of Gains

The Canadian dollar fell on Thursday after two days of gains and maintained its weakness during the Asian trading hours on Friday. One of the possible reasons for the decline of the currency was the waning support from the deal to cut oil production announced by the Organization of Petroleum Exporting Countries on Wednesday. The output limit should support oil prices, and that boosted futures for the commodity as well as currencies of oil-exporting countries. Yet now, the rally is waning as traders … “Canadian Dollar Goes Lower After Two Days of Gains”

Interest Rate Hike Doesn’t Help Mexican Peso

The central bank of Mexico raised interest rates on Thursday, but the market demonstrated limited reaction to the news. The Mexican peso fell during Friday’s Asian trading session, continued to be driven by concerns about the US presidential elections. The Banco de Mexico increased its main interest rate by 50 basis points to 4.75% on Thursday. Now it stands at the highest level since 2009. A rate hike was expected by analysts, surveyed … “Interest Rate Hike Doesn’t Help Mexican Peso”

USD/CAD To Test 1.30 N-Term; GBP/USD Fair Value Is

Both USD/CAD and GBP/USD trade at similar levels. But their directions may be different. The loonie enjoyed the recent OPEC agreement and the pound suffers from the Hard Brexit talk. What’s next? Here is the view from BNP Paribas: Here is their view, courtesy of eFXnews: Crude prices are holding onto gains from late Wednesday, setting … “USD/CAD To Test 1.30 N-Term; GBP/USD Fair Value Is”

Domestic Data & Market Sentiment Drive Yen Down

The Japanese yen fell today, driven down by both poor domestic macroeconomic data and the general market sentiment that was favoring currencies with higher yield, not safe ones. Japan’s retail sales fell 2.1% in August year-on-year and 1.1% month-over-month. The drop was bigger than analysts’ had predicted. Meanwhile, the surprise agreement to cut oil production announced by the Organization of Petroleum Exporting Countries continued to bolster investors’ confidence, … “Domestic Data & Market Sentiment Drive Yen Down”

Pound Under Pressure from Stimulus Expectations

The Great Britain pound fell against some of its rivals today, continuing to experience pressure from stimulus expectations. The currency managed to beat the Japanese yen, though, as risk appetite made investors less interested in safe currencies. Yesterday, Bank of England Deputy Governor Minouche Shafik signaled that timing of additional monetary easing depends on economic data, though she would rather “act preemptively,” and such comments hurt the sterling. … “Pound Under Pressure from Stimulus Expectations”

How Will the Forex Markets React to the US Election

In the immediate aftermath of Hilary Clinton’s resounding success during the first Presidential debate this week, the New Yorker ran a hilarious satirical post claiming that Trump would boycott any future debates in which his rival was also allowed to participate. This encapsulates the ego-centric nature of Trump’s campaign so far, in which brashness and … “How Will the Forex Markets React to the US Election”