Flash euro-zone PMIs are set to show an improvement in November. High expectations may lead to a downfall for EUR/USD. Only a substantial surprise has room to lift the common currency. ECB’s Lagarde’s speech may steal the show. Improvements are all fronts – that is what economists expect from Markit’s flash Purchasing Managers’ Indexes for November. … “Euro-zone PMIs may be lose-lose for EUR/USD – Three scenarios”

Month: November 2019

EURJPY In For Further Uspide Within an Elliott Wave Leading Diagonal – Elliott Wave analysis

It seems that a probable Elliott wave leading diagonal can be in progress from the lows on EURJPY with a price ending a fourth wave correction, so be aware of one more leg higher, before a temporary A-B-C correction starts developing. EURJPY, daily On the 4h chart of EURJPY, the pair made a strong turn … “EURJPY In For Further Uspide Within an Elliott Wave Leading Diagonal – Elliott Wave analysis”

Scandinavian Capital Markets Launches cTrader for Retail and Institutional Traders

Scandinavian Capital Markets is proud to announce a further expansion of their trading platform offering, with the addition of multi-award-winning cTrader, available to both their Retail and Institutional Clients. Trusted by millions of traders worldwide and supported by a large community of partners, cTrader incorporates the most advanced tools, offering state-of-the-art technology for fast entry … “Scandinavian Capital Markets Launches cTrader for Retail and Institutional Traders”

USD/JPY may extend its falls as global worries persist

USD/JPY has been mixed amid trade and central bank headlines. The Federal Reserve’s minutes stand out. Mid-November’s daily chart continues painting a bullish picture. The FX Poll is showing further falls for the currency pair in the medium and long terms. President Donald Trump’s bashing of China has boosted the safe-haven yen, while the Federal Reserve refrained … “USD/JPY may extend its falls as global worries persist”

GBP/USD: Is Boris-related bump justified? Every poll matters

GBP/USD has been rising alongside the Conservatives’ reelection chances. Opinion polls, trade headlines, and further Fed news are set to determine the next cable moves. Mid-November’s daily chart is pointing to falling momentum for the pound. Conservatives are consolidating their lead – that pound-positive development has overshadowed all other events, including poor UK figures. The run-up … “GBP/USD: Is Boris-related bump justified? Every poll matters”

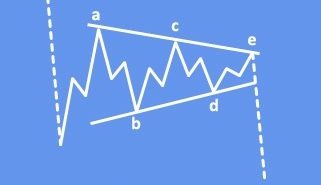

Oil: Interesting Elliott Wave Triangle pattern Points Lower

Crude oil jumped towards 63.00 zones and tested the upper side of a 2019 trading range where upside was limited, and a new leg lower started developing. We labeled that same leg down as wave D, as part of a bigger complex correction, which fully developed and pushed the price into the final leg E … “Oil: Interesting Elliott Wave Triangle pattern Points Lower”