The euro jumped today even though an inflation report from the eurozone was not as good as economists have hoped for. Over a longer term, the currency moves sideways versus the euro and demonstrates bullish bias versus the US dollar. The eurozone Consumer Price Index rose 0.5 percent in June on an annual basis, at the same rate as in May. Analysts have expected inflation to accelerate to 0.6 percent. The European Central Bank conducts a monetary … “Euro Climbs Even as Eurozone Inflation Doesn’t Accelerate”

Month: June 2014

Outlook for USD During Week of NFP & Independence Day

The US dollar experienced a very poor trading month in June due to unexpected dovishness of US policy makers and terrible GDP report. Can the greenback change the bearish trend in the first trading week of the new month? Unlike the last week, this weekâs fundamentals are expected to be mostly supportive for the US currency. The major event will be release of non-farm payrolls, which will be issued earlier than usual (on Thursday … “Outlook for USD During Week of NFP & Independence Day”

CAD Drops on GDP Report, Pares Losses

Canada’s gross domestic product grew in April less than was expected by analysts, triggering a drop of the Canadian dollar. The currency is currently recovering, trimming losses versus the Japanese yen and trading close to the opening level against its US peer. GDP expanded 0.1 percent in April, at the same rate as in March. The growth was below the median forecast of 0.2 percent. The loonie (as the Canadian currency is nicknamed) dropped due to the report … “CAD Drops on GDP Report, Pares Losses”

USD/JPY: Trading the ISM Manufacturing PMI Jun 2014

ISM Manufacturing PMI (Purchasing Managers’ Index) is based on a survey of purchasing managers in the manufacturing sector. Respondents are surveyed for their view of the economy and business conditions in the US. A reading which is higher than the market forecast is bullish for the dollar. Here are all the details, and 5 possible … “USD/JPY: Trading the ISM Manufacturing PMI Jun 2014”

Yen Loses Support of Fundamentals, Halts Rally

The Japanese yen halted its rally today and actually fell against some of its major peers as economic reports were not favorable to the currency. Today’s drop followed Friday’s big rally, meaning that part of today’s losses may be attributed to profit-taking. Japan’s industrial production rose 0.5 percent in May on a seasonally adjusted basis, while analysts predicted a 0.9 percent increase. Housing starts slumped 15.0 percent … “Yen Loses Support of Fundamentals, Halts Rally”

NZ Dollar Slumps, Undermined by Poor Fundamental Data

The New Zealand dollar tumbled today, pushed down by very poor macroeconomic indicators. Not everything in today’s report was bad, but the data was negative enough to cause a massive slump of the currency. Building consents dropped 4.6 percent in May following the 1.9 percent increase in the previous month. Yet the seasonally adjusted number of new dwellings, excluding apartments (apartment number tends to strongly fluctuate from month to month), rose … “NZ Dollar Slumps, Undermined by Poor Fundamental Data”

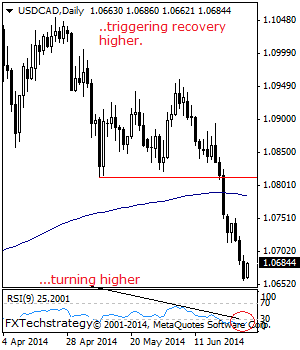

USD/CAD: Triggers Corrective Recovery

USDCAD: With USDCAD triggering a correction during early trading today, further upside could be seen in the days ahead. However, broader bias still points lower in the medium term. On the downside, support lies at the 1.0600 level where a break will aim at the 1.0550 level and then the 1.0500 level. Further down, support … “USD/CAD: Triggers Corrective Recovery”

Where is the fall of EUR/USD?

The ECB has set a historic negative deposit rate and announced a series of measures to stimulate the economy and push inflation higher. The high value of the euro keeps inflation and growth depressed and Draghi made explicit comments tying the exchange rate to monetary policy. Nevertheless, at 1.3650, EUR/USD is basically at the top of the … “Where is the fall of EUR/USD?”

FX Outlook 2014 Q3 and Beyond

Editor’s note: We hereby bring the Q3 and beyond foreign exchange outlook written by FxPro Head of Research Simon Smith. Executive Summary We did not start the year as secular dollar bulls but were still over-taken by the disappointing dollar performance, largely (but not wholly) down to the weaker US economy in Q1. Central banks … “FX Outlook 2014 Q3 and Beyond”

Australia retail forex brokers MXT Global and Vantage FX

By Andrew Saks-McLeod With a strong focus on the much coveted Asia Pacific region, Australian brokerages MXT Global and Vantage FX combine to provide technological and territorial synergies. Source: Leap Rate