Greece has made a suggestion for a 2 year bailout plan under the ESM. The program includes debt restructuring and the ejection of the IMF. The medium term solution and the other ideas all sound good, but they are probably unacceptable in Germany. Here are the advantages and why chances are low for a YES from Germany: Advantages Long … “Analysis: Greek proposal makes sense, but probably unacceptable for”

Month: June 2015

GBP Lower vs. USD & JPY, Higher vs. EUR After Mixed Data

The Great Britain pound edged a little lower against the US dollar and the Japanese yen but gained on the euro today after the release of macroeconomic data from the United Kingdom. The reports were mixed, providing no clear direction for the currency. Britain’s gross domestic product rose 0.4 percent in the first quarter of this year according to the final revision, up 0.1 percent from the previous estimate. Most analysts were counting on exactly … “GBP Lower vs. USD & JPY, Higher vs. EUR After Mixed Data”

Canadian Dollar Sinks with Oil Prices

The Canadian dollar sank yesterday and retained its losses today due to the drop of crude oil prices. Crude declined as the complicated situation with Greece deterred traders from buying commodities. West Texas Intermediate grade of crude oil (US benchmark grade) continues to trade below the $60 level. Prices were under pressure from the risk-averse sentiment on the market caused by Greece. Oversupply is also a concern, especially considering the possibility … “Canadian Dollar Sinks with Oil Prices”

Euro Bounces During Monday’s Volatile Trading

The euro demonstrated a surprise performance during Monday’s trading. The currency sank initially due to the worries about the Greek debt drama, yet the losses were short-lived and for some reason the euro bounced strongly after the initial drop. As was expected, the start of the week was highly volatile. It is hard to say why the shared eurozone currency rallied as news was not helpful at all. Greece threatened to go to the European Court of Justice … “Euro Bounces During Monday’s Volatile Trading”

5 Reasons Why EUR/USD is higher after the Greek

EUR/USD is trading at 1.1250 already reaching 1.1276, over 100 pips from the close on Friday. Since Friday, the Greek crisis went into overdrive, with the breakup of talks, the Greferendum announcement, the rejection of the bailout, the ECB freeze of ELA and the capital controls. A lot of alarming events. So how come the Sunday … “5 Reasons Why EUR/USD is higher after the Greek”

Swiss Franc Recovers Despite Actions of SNB

The Swiss franc gained today against the US dollar and the euro as the risk-negative sentiment on the Forex market drove investors to the safety of the Swiss currency. Initially, the Swissie traded lower versus the greenback due the intervention from the central bank. Thomas Jordan, Chairman of the Swiss National Bankâs governing board, announced that the SNB intervened in the market to stabilize the franc, which attracted speculators due to the perceived safety of the currency. The Swissie is usually in demand in times … “Swiss Franc Recovers Despite Actions of SNB”

Mexican Peso Suffers from Risk Aversion Caused by Greece

The Mexican peso fell against the US dollar today as the debt crisis in Greece made traders unwilling to buy riskier currencies of emerging economies. The currency bounced from the daily low as of now but is still trading below the opening level. Greece shocked everyone last week, announcing a referendum about the austerity measures proposed by the International Monetary Fund and the European Union. The voting is scheduled for July 5, meaning that the country … “Mexican Peso Suffers from Risk Aversion Caused by Greece”

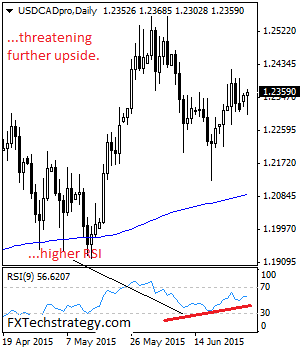

USD/CAD Recovering With Caution

USDCAD: Although is seen threatening recovery higher, as long as it trades below the 1.2421 level, we still see risk to the downside. On the upside, resistance is seen at the 1.2400 level followed by the 1.2450 level. Further out, resistance comes in at the 1.2500 level where a turn lower may occur. But if … “USD/CAD Recovering With Caution”

Greek crisis: will the US force debt relief?

Or to put it in a different way: did Tsipras escalate the situation in order to pull in the US and force Germany to accept relief on Greek debt? Imagining the small debt stricken nation maneuver the world’s superpower seems a bit out there, but the US Treasury secretary Jack Lew has already spoken with the creditors, including his German … “Greek crisis: will the US force debt relief?”

USD/CAD: Trading the Canadian GDP Jun 2015

GDP is a measurement of the production and growth of the economy, and analysts consider GDP one the most important indicators of economic activity. A reading which is better than the market forecast is bullish for the Canadian dollar. Here are all the details, and 5 possible outcomes for USD/CAD. Published on Tuesday at 12:30 … “USD/CAD: Trading the Canadian GDP Jun 2015”