The past trading week was marked with several policy meetings of major central banks. The most interesting of them turned out to be the Bank of Japan meeting that resulted in a surprise cut of the interest rates into negative territory. As one can expect, this resulted in a slump of the Japanese yen. Not many market participants had expected Japan’s central bank to reduce rates, thinking that it would rather tweak … “Bank of Japan Responsible for Weekly Losses of Yen”

Month: January 2016

Crude Oil Remains Friend to Canadian Dollar

Crude oil continued to rise over the Friday’s trading session, meaning that the Canadian dollar was rising as well. The loonie tends to show a strong correlation to moves of crude oil prices, and the correlation was especially noticeable during the recent time. Crude continued to rise on speculations that Saudi Arabia and Russia would be able to reach an agreement to cut output, supporting prices. Additionally, the number of US oil rigs declined this … “Crude Oil Remains Friend to Canadian Dollar”

NZ Dollar Follows Performance of Australian Dollar

The New Zealand dollar demonstrated the same performance as its Australian counterpart today. Namely, it rose against some major rivals, like the euro and the Japanese yen, but was unable to beat the US dollar. The major event for the currency markets during the current trading session was the monetary policy decision of Japan’s central bank. That, together with the rally of crude oil prices, boosted commodity-linked currencies, like the Australian and New … “NZ Dollar Follows Performance of Australian Dollar”

Australian Dollar Higher vs. Majors, Unable to Beat US Dollar

The Australian dollar gained on some of its major counterparts, like the very weak Japanese yen, during the current trading session. The Aussie was unable to beat the US dollar, though, as economic data from Australia missed expectations. The Australian Producer Price Index grew 0.3 percent in December quarter from the previous three months, two times slower than the pace predicted by analysts. Private sector credit rose 0.5 percent … “Australian Dollar Higher vs. Majors, Unable to Beat US Dollar”

Focus on Brexit Overshadows UK Economy

The UK pound is turning lower against the dollar today, although it is still holding out against the euro. While there has been some good economic data, there are still concerns about a possible exit from the European Union. Sterling has been doing fairly well in recent days. GDP readings came in at a 0.5 per cent increase in the fourth quarter of 2015, with a 1.9 per … “Focus on Brexit Overshadows UK Economy”

Yen Sinks as BoJ Implements Negative Interest Rates

The Bank of Japan surprised the market by pushing its interest rates into negative territory at today’s monetary policy meeting. As one could expect, such decision led to a slump of the Japanese yen against other most-traded currencies. The BoJ announced today that it cut its main interest rate from 0.1 percent to -0.1 percent. Specifically, the bank will use the three-tier system (similar to the system used by other major central … “Yen Sinks as BoJ Implements Negative Interest Rates”

Don’t Abandon The Dollar: Here Is Why – BNPP

The US dollar seems to be on the back foot following a cautious FOMC statement and poor data. BNP Paribas says dollar bulls can keep the faith: Here is their view, courtesy of eFXnews: The FOMC’s 27 January statement made a subtle shift towards a more cautious message, notes BNP Paribas. “The statement dropped language … “Don’t Abandon The Dollar: Here Is Why – BNPP”

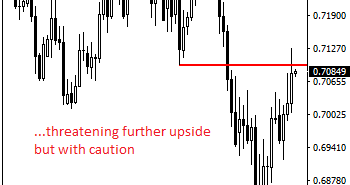

AUDUSD Caps Strength Below The 0.7096 Zone

AUDUSD: Although AUDUSD remains biased to the upside on correction, it continues to retain its broader medium term bias below the 0.7096 zone. Unless that is decisively taken our, the pair faces downside pressure. On the downside, support resides at the 0.7040 level where a breach will aim at the 0.7000 level. Below that level … “AUDUSD Caps Strength Below The 0.7096 Zone”

EUR: Time For Draghi To Save The World, Again –

The recent talk of downside risks sent EUR/USD down but it quickly recovered since. Will Draghi deliver next time? The team at Credit Agricole discusses: Here is their view, courtesy of eFXnews: The latest market turmoil signalled growing fears about the outlook of the global economy. These concerns are exacerbated by the overhang of USD-debt … “EUR: Time For Draghi To Save The World, Again –”

Soaring Crude Oil Prices Benefit Canadian Dollar

The Canadian dollar was tracking move of crude oil very closely in the recent past, and today’s trading session was no different. Prices for crude rallied, and the loonie followed them. There were reports that Saudi Arabia approached Russia with an offer to make a deal between OPEC and non-OPEC producers to cut output. Such move is expected to buoy oil prices. There is nothing tangible yet, and many analysts … “Soaring Crude Oil Prices Benefit Canadian Dollar”