The Mexican peso declined today as worries that the US Federal Reserve may trim its asset-purchase program made investors unwilling to keep riskier currencies of emerging nations. Traders are worried that signs of stable economic growth may encourage the Fed to cut its monetary stimulus. Such worries hurt currencies of emerging markets and the peso was the worst performer among Latin American currencies today. The currency was still … “Mexican Peso Weakens on Fed Tampering Concerns”

Month: July 2013

Ringgit Falls as Traders Sell Malaysian Bonds

The Malaysian ringgit fell today as on concerns about capital outflows and cut of the country’s credit rating. Investors were selling the nation’s bonds as US Treasury yield was rising. Fitch Ratings changed the outlook for Malaysiaâs A- credit rating from stable to negative yesterday. Concerns that traders will pull out their money from the country as the United States prepare to reduce stimulus made the ringgit fall 2.7 percent over … “Ringgit Falls as Traders Sell Malaysian Bonds”

Fed Chairman Larry Summers? Turbulent Times Ahead

There is a growing notion that the Larry Summers will be the next Chairman of the Federal Reserve, replacing Ben Bernanke. US President Barack Obama reportedly made a “full throat” defense of Summers, as supporters of the former treasury secretary seem to have the upper hand in convincing Obama for the nomination, over Vice Chair … “Fed Chairman Larry Summers? Turbulent Times Ahead”

Greenback Gains on ADP and GDP

US dollar is heading higher today, gaining ground as the latest economic data adds to the speculation that the Federal Reserve could begin tapering its asset purchase program sooner rather than later. With private payrolls increasing and with the news that GDP rose in the second quarter of 2013, it looks like the US economic recovery is rolling forward. Greenback is higher against its major counterparts … “Greenback Gains on ADP and GDP”

Euro Continues to Struggle a Bit Against the US Dollar

Euro continues to struggle a bit against the US dollar today, even after the latest unemployment release in the eurozone. Signs that a muted recovery might come into play during the last part of 2013 are not quite enough for the 17-nation currency to log gains against the greenback right now. For the first time in more than two years, unemployment in the eurozone has fallen. Eurostat reports that 24,000 fewer people in the eurozone … “Euro Continues to Struggle a Bit Against the US Dollar”

EUR/USD: Trading the first US GDP July 2013

US Advance GDP is a measurement of the production and growth of the economy. Analysts consider GDP one the most important indicators of economic activity. Thus, publication of US Advance GDP could have a significant impact on the movement of EUR/USD. A reading which is higher than the market forecast is bullish for the dollar. Here are all the details, and … “EUR/USD: Trading the first US GDP July 2013”

ECB may try to avoid rate cut if possible, BOE

A cut of the main lending rate in the euro-zone could have a very limited impact, so Draghi and his colleagues at the ECB might try other means before making this move, says Simon Smith of FxPro. Also Mark Carney’s BOE has a fine balancing act of preventing from the headwinds of QE tapering in … “ECB may try to avoid rate cut if possible, BOE”

USD/JPY: Trading the ISM Manufacturing PMI Jul 2013

ISM Manufacturing PMI (Purchasing Managers’ Index) is based on a survey of purchasing managers in the manufacturing sector. Respondents are surveyed for their view of the economy and business conditions in the US. A reading which is higher than the market forecast is bullish for the dollar. Here are all the details, and 5 possible … “USD/JPY: Trading the ISM Manufacturing PMI Jul 2013”

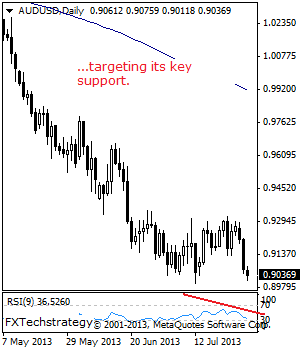

AUDUSD: Focus Remains On The 0.8997 Level

AUDUSD: With continued bearishness seen, the risk is for more weakness towards the 0.9000/0.8997 levels to occur. A breach of here will call for a run at the 0.8900 level and possibly lower towards the 0.8850 level. Its daily RSI is bearish and pointing lower supporting this view. Conversely, AUDUSD will have to recapture the … “AUDUSD: Focus Remains On The 0.8997 Level”

CAD Soft as Traders Nervously Wait for Fed Statement

The Canadian dollar was soft ahead of the US Federal Reserve policy meeting. Traders speculated that the Fed may give hints about details of quantitative easing tampering. Market participants are afraid of QE reduction as it will likely hurt prospects for export-oriented economies. The Canadian dollar, being a commodity-related currency, is vulnerable to such fears. Yesterday’s drop of oil prices by as much as 1.4 percent did not help the loonie … “CAD Soft as Traders Nervously Wait for Fed Statement”