The US dollar ended this week with gains even though it looked like fundamentals were against the US currency. The greenback was particularly strong against the euro, and this was surprising considering the progress in the situation with Greece. At the same time, the dollar was unable to beat the Great Britain pound. The dollar struggled after the testimony of Janet Yellen, Federal Reserve Chairperson, made speculators reconsider the potential timing for an interest … “Dollar Ends Week on Strong Note, Defying Adverse Fundamentals”

Month: February 2015

Euro Heads Higher For Now

Euro is heading higher for now, gaining ground against its major counterparts. After a great deal of political theater, a bailout deal has been reached with Greece, and there is news that euro-denominated emerging market issuance is heading it its highest level in a decade. All of this is points to a calm for the euro, but it may not last long. Right now, the euro is experiencing … “Euro Heads Higher For Now”

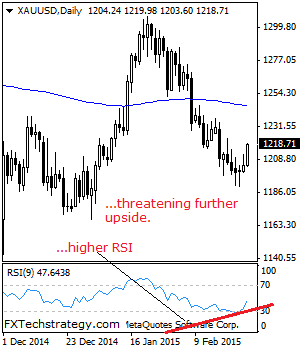

GOLD: Bullish, Extends Corrective Recovery

GOLD: With GOLD recovering strongly on Thursday (together with the EUR/USD crash), further strength is envisaged in the days ahead. On further upside, resistance resides at the 1,230.00 level where a break will aim at the 1,250.00 level, its key psycho level. A break of here will turn attention to the 1,280.00 level followed by … “GOLD: Bullish, Extends Corrective Recovery”

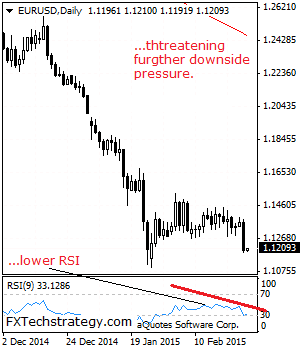

EURUSD: Declines On Sell Off

EURUSD: With EUR triggering a strong sell-off on Thursday, further downside pressure is envisaged. Support is seen at 1.1100 level with a cut through here opening the door for more downside towards the 1.1050 level. Further down, support lies at the 1.1000 level where a break will expose the 1.0950 level. Its daily RSI is … “EURUSD: Declines On Sell Off”

Rising CPI Doesn’t Help Canadian Dollar

The Canadian dollar fell against its US counterpart today despite positive macroeconomic data from Canada. The currency also retreated against the Japanese yen but gained on the very weak euro. Canada’s Consumer Price Index fell 0.2 percent in January while the core CPI rose at the same rate. The data was not stellar, yet it was still better than analysts’ forecast. Year-on-year, consumer prices grew … “Rising CPI Doesn’t Help Canadian Dollar”

Dollar Posts Substantial Gains After Mixed Data

Today’s data from the United States was rather mixed but it did not prevent the US dollar from demonstrating an impressive rally. The currency rose to the highest level in a month against the euro. There were several macroeconomic reports from the USA today. Some of them were good, like durable goods orders, some of them bad, like unemployment claims. Yet others were harder to crack: the Consumer Price … “Dollar Posts Substantial Gains After Mixed Data”

Australian Dollar Reverses Thursday’s Losses

The Australian dollar fell at the start of today’s trading session as macroeconomic data from Australia disappointed trades. Yet for whatever reason the currency managed to bounce and is trading above the opening level right now. Australian private capital expenditure fell 2.2 percent in the fourth quarter of the last year on a seasonally adjusted basis after rising in the previous three months. Analysts expected a drop but not that big. The Australian dollar was … “Australian Dollar Reverses Thursday’s Losses”

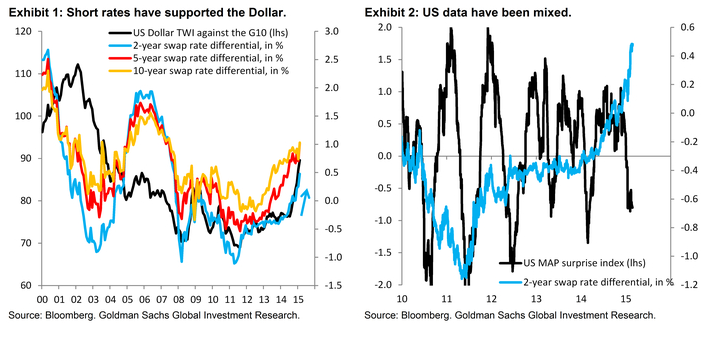

The Case For Cutting Our EUR/USD Forecasts – Goldman

EUR/USD has been stuck in range for quite a while, and fails to choose a new direction. How long will this last? The team at Goldman Sachs still sees a downwards move and goes further to cut forecasts to lower ground for the next 3,6 and 12 months. Here is their rationale and the chart: Here … “The Case For Cutting Our EUR/USD Forecasts – Goldman”

EUR/USD: Trading the Preliminary US GDP

US Preliminary GDP (also referred to as Second Release GDP) measures the growth of the economy. Analysts consider GDP one the most important indicators so the Preliminary GDP report can have a significant impact on the movement of EUR/USD. A reading which is higher than the market forecast is bullish for the dollar. Here are all the details, and … “EUR/USD: Trading the Preliminary US GDP”

Positive Trade Balance Lifts New Zealand Dollar

The New Zealand trade balance turned positive in January, surprising analysts who expected it to remain in the negative territory. The New Zealand dollar rallied as a result. The New Zealand trade balance had a surplus of NZ$56 million in January after posting a deficit of NZ$195 million in December. Market experts counted on a shortage of NZ$162 million. The positive data allowed the NZ dollar to rally to the highest level since January 21 against the US dollar … “Positive Trade Balance Lifts New Zealand Dollar”