EUR/USD has been stuck in range for quite a while, and fails to choose a new direction. How long will this last?

The team at Goldman Sachs still sees a downwards move and goes further to cut forecasts to lower ground for the next 3,6 and 12 months. Here is their rationale and the chart:

Here is their view, courtesy of eFXnews:

Goldman Sachs cuts today its EUR/USD forecasts stating that its conviction remains that the Dollar has a lot more room to strengthen, despite its sharp rise since mid-2014.

USD Strength Not Done Yet:

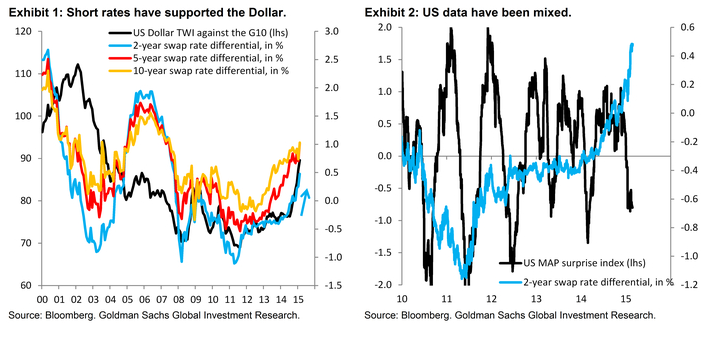

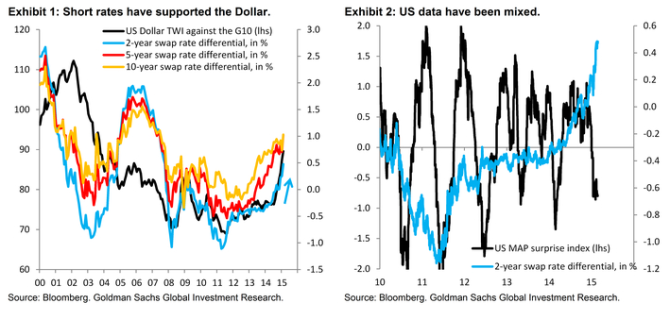

“Underlying that view is a US activity picture that remains solid (the January CAI is 3.3% and Q1 GDP is tracking at 2.7%) and a Fed that is gradually approaching lift-off, which will likely keep the 2-year rate differential against the G-10 moving in favour of the Dollar this year,” GS argues.

Unfounded Concerns:

“The Dollar bull view has recently fallen out of favour, with many thinking the greenback will go sideways this year. This caution reflects the fact that US data have been more mixed recently and an expectation for a cyclical rebound in Europe, which some see as a catalyst for EUR/$ to rebound somewhat. ,” GS adds

No Reason To Buy The EUR:

“In that context, the emerging compromise between Greece and its lenders is cited as a reason to buy the Euro. We don’t agree. In the end, our bullish Dollar view is about cyclical outperformance of the US vis-a-vis the G10. A compromise on Greece keeps that story intact, in particular since any compromise will be on a continuation of financing for Greece and fail to address the pressing growth crisis across much of the Euro area periphery,” GS argues.

“In short, even if agreement from Greece avoids (for now) an escalation of the crisis and a more substantial fall in the EUR, it should set us up nicely for a continued rally in the Dollar for the remainder of the year as the market reconnects with the trending divergence between the US and Euro area,” GS adds.

All in All, Cutting EUR/USD Forecasts:

“In that light, we mark to market our Euro down view, revising our 3- and 6-month forecast for EUR/$ down to 1.12 and 1.10, respectively, from 1.14 and 1.11 previously, while keeping our 12-month forecast unchanged at 1.08,” GS projects.

For lots more FX trades from major banks, sign up to eFXplus

By signing up to eFXplus via the link above, you are directly supporting Forex Crunch.