EUR/USD is at crossroads: despite the slide, it is hesitating and lacking conviction. What’s next? The team at Nordea checks out both options: A special segment ahead of the big Brexit vote: The Fed’s fears has gradually receded, prompting a surge in likelihood for a summer hike which has put the USD back on track (+3% … “EUR/USD: Gradual Or Glacial? A Buy On Dips Or A”

Month: May 2016

AUD/USD: Trading the Australian GDP

Australian GDP is the primary gauge of the production and growth of the economy. It is considered by analysts as one the most important indicators of economic activity, and a reading which is higher than expected is bullish for the Australian dollar. Here are all the details, and 5 possible outcomes for AUD/USD. Published on Wednesday at … “AUD/USD: Trading the Australian GDP”

CAD: Rate Spreads Taking Over From Oil; USD: Payroll

It’s a very busy week for markets with a buildup to the NFP, OPEC meetings and lots more. The team at CIBC look at the situation in North America: Here is their view, courtesy of eFXnews: CAD: Rate Spreads Taking Over From Oil. No economic news was good news for the Canadian dollar this week, particularly … “CAD: Rate Spreads Taking Over From Oil; USD: Payroll”

CAD Falls vs. USD & EUR, Gains on JPY

The Canadian dollar fell against the US dollar and the euro today, though currently it is trying to reverse losses against the former. The loonie fared far better against the yen, gaining on the Japanese currency. The Canadian dollar was feeling the pressure from the probable interest rate hike by the Federal Reserve that has been supporting the US dollar and driving other currencies down. Additionally, the intraday drop of crude oil gave even … “CAD Falls vs. USD & EUR, Gains on JPY”

Dollar Index Edges Higher Following Friday’s Comments from Yellen

The US dollar continued to benefit from the outlook for monetary tightening from the Federal Reserve, rising against a basket of currencies during Monday’s trading. The greenback gained mostly on currencies of emerging markets, while its performance versus major currencies was far from stellar. Fed Chair Fed was speaking on Friday, and she has signaled that the Fed may tighten monetary policy “in the coming months.” Such comments supported the dollar, … “Dollar Index Edges Higher Following Friday’s Comments from Yellen”

Economic Confidence Reading Gives Euro a Boost

Euro is getting a big of a boost today, thanks to an improved economic confidence reading. Stimulus appears to be working to some degree, and many expect the ECB to keep its rates unchanged at the policy meeting later this week. The latest reading of a consumer confidence index in the eurozone showed an increase to 104.7 from 104.0. This seems to show that the situation in the 19-nation currency region is improving, and that we are likely to see … “Economic Confidence Reading Gives Euro a Boost”

What I talk about when I talk about EUR/USD

In the special segment for today we discussed some things that stand out in the world’s most popular currency pair: from fundamental matters to technical ones, with many traders having a love-hate relationship. Does the high liquidity support better technical behavior or undermine it? It’s an interesting debate we had on the show. EUR/USD is … “What I talk about when I talk about EUR/USD”

AUD Rebounds vs. USD, Shrugging Off Poor Fundamentals

The Australian dollar had been weak against its US peer intraday but has bounced as of now. The currency even managed to gain on the Japanese yen even though domestic fundamentals were not supportive to the Aussie at all. The Housing Industry Association reported that the number of new home sales declined 4.7% in April. According the report from Australian Bureau of Statistics, company gross operating profit also fell by 4.7% in the March … “AUD Rebounds vs. USD, Shrugging Off Poor Fundamentals”

Yen Falls with Declining Retail Sales & Rising Stocks

The Japanese yen fell today amid falling retail sales and the investor’s improving sentiment that was triggered by the rise of stock indexes. Japan’s retail sales fell 0.8% in April. The drop was not bad compared to the predicted decrease by 1.2%. Therefore, the more important factor for the yen’s drop were the gains of the S&P 500 and the Nikkei 225 stock indexes. USD/JPY rose from 110.41 to 111.12 as of 10:11 GMT today, and its daily … “Yen Falls with Declining Retail Sales & Rising Stocks”

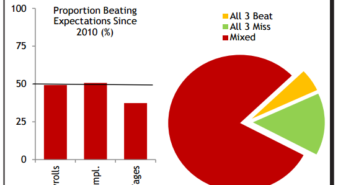

NFP Preview: Mind The Revision Gap

Expectations are somewhat lower for the upcoming Non-Farm Payrolls report. But it’s not only the headline figure and not only the wages. Here is a preview from Bank of America Merrill Lynch, also explaining the US impact: Here is their view, courtesy of eFXnews: In the May employment report, we expect nonfarm payroll growth of … “NFP Preview: Mind The Revision Gap”