The US dollar has been left, right and center in recent days, but there are two sides to a currency pair. The euro did receive some positive economic indicators, but Greece looms. The team at Deutsche Bank explains why EUR/USD is still a good short: Here is their view, courtesy of eFXnews: In a note … “A USD Story But EUR Still A Good Short; Sell”

Month: May 2015

Canadian Dollar Demonstrates Weakness During Trading Week

The Canadian dollar experienced weakness during the past week. While the currency managed to rally against the Japanese yen, the loonie demonstrated losses versus the US dollar and the euro. The currency started trading on a weak note, mostly due to the drop of prices for crude oil. Oil prices bounced by the end of the trading week providing some support to the Canadian dollar, but the news from Canada itself did not allow the nation’s currency to regain much … “Canadian Dollar Demonstrates Weakness During Trading Week”

Loonie Recovers After Hit from Canadian GDP

The Canadian dollar sank today after data that showed an unexpected decline of Canada’s economy. The currency recovered somewhat by the end of the trading session, erasing losses against the US dollar and the Japanese yen, also trimming the drop versus the euro. Canada’s gross domestic product fell 0.2 percent in March from February and declined 0.1 percent in the first quarter of 2015 from the previous three months. The report was a bitter disappointment for many … “Loonie Recovers After Hit from Canadian GDP”

Dollar Drops vs. Euro, Gains for Sixth Day vs. Pound & Yen

The US dollar fell against the euro today after macroeconomic reports that were largely negative. Still, the currency managed to gain on the Great Britain pound and the Japanese yen, demonstrating the sixth consecutive session of gains. The most important report today was the second estimate of gross domestic product in the first quarter of this year. The data showed a drop by 0.7 percent instead of the increase by 0.2 percent showed by the first estimate. The problem with … “Dollar Drops vs. Euro, Gains for Sixth Day vs. Pound & Yen”

EUR: Time To Panic? – Credit Agricole

The clock is ticking towards the June 5th deadline for Greece, that scrambles to collect cash. Is the market too complacent about this crisis? The team at Credit Agricole assesses the risks for the common currency: Here is their view, courtesy of eFXnews: The Euro’s recent consolidation belies greater uncertainty about the outcome of the … “EUR: Time To Panic? – Credit Agricole”

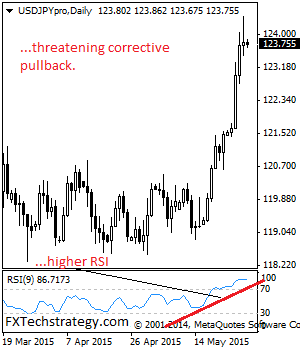

USDJPY: Sets Up To Correct Lower

USDJPY: Having capped its strength at the 124.45 level to close marginally higher on a rejection candle on Thursday, further weakness is expected. On the upside, resistance resides at the 124.50 level with a turn above here aiming at the 125.00 level. A break will target the 125.50 level. Further out, resistance comes in at … “USDJPY: Sets Up To Correct Lower”

Bank of Canada Limits Canadian Dollar Upside Potential

Bank of Canada Limits Loonie Upside, Oil Only Saving Hope for Bulls The Government of Canada has confirmed the dampening of the Canadian dollar rally by maintaining the overnight target rate at .75% and also specifically mentioning the impact of the Canadian dollar in its release. The specific mention of the Canadian dollar in its … “Bank of Canada Limits Canadian Dollar Upside Potential”

NZD Touches Lowest Since 2010 vs. USD

Economic data from New Zealand was rather poor today, leading to a drop of the nation’s currency. The New Zealand dollar touched the lowest level since September 2010 against its US peer. Building consents fell 1.7 percent in April (seasonally adjusted) following the 10 percent increase in March. The ANZ Business Confidence fell from 30.2 in April to 15.7 in May. The report pointed out that, while the confidence declined, … “NZD Touches Lowest Since 2010 vs. USD”

Yen Supported by Data from Japan

The Japanese yen gained on the US dollar and the Great Britain pound today as macroeconomic data from the Asian country was mostly positive, increasing appeal of the currency to investors. Japan’s core Consumer Price Index rose 0.3 percent in April while the Tokyo core CPI rose 0.2 percent in May, in line with expectations. Industrial production increased 1 percent in April on a seasonally adjusted basis, slightly above forecasts. Not every … “Yen Supported by Data from Japan”

Dollar Softens After Mixed Data

The US dollar softened today after the release of mixed economic data from the United States. The currency trimmed its gains against the Great Britain pound and the Japanese yen while against the euro the greenback demonstrated losses. Pending home sales rose 3.4 percent in April to the highest level since May 2006. Meanwhile, initial claims for unemployment benefits rose by 7,000 to 282,000 last week instead of falling as analysts had predicted. … “Dollar Softens After Mixed Data”