The South African rand weakened today on signs that the central bank may intervene to curb volatility of the exchange rate. Central bankâs Deputy Governor Daniel Mminele said that swings of the currency are “somewhat exaggerated”. He explained that policy makers favor a flexible exchange rate, but are worried by “abrupt and disorderly movements”. Such comments led to speculations that the South African Reserve Bank may intervene to reduce … “Rand Falls as Central Bank Concerned by Volatility”

Month: May 2013

Real Weak vs. Dollar After Central Bank Makes Surprise Decision

The Brazilian real fell today amid speculations that positive US macroeconomic data will spur the US Federal Reserve to tighten its monetary policy. Brazil’s central bank already increased its interest rates, surprising Forex market participants. The Central Bank of Brazil increased its main interest rate to 8 percent on May 29. The bank said: The Committee evaluates that this decision will contribute to set inflation … “Real Weak vs. Dollar After Central Bank Makes Surprise Decision”

CHF looks promising, but don’t get complacent

Switzerland is proving its mettle as a safe haven economy with exports and domestic consumption doing well; however traders should remember that one of the reasons for this performance is the successful devaluation of CHF. As currency devaluations go for developed economies few were more spectacular than the raid carried out by the Swiss National … “CHF looks promising, but don’t get complacent”

Euro Lower as Unemployment Reaches Another High

Euro is heading lower today as risk aversion sets in, and as Forex traders consider that unemployment in the eurozone is hitting yet another high. With economic concerns, and with commodities in retreat, there isn’t much to support the euro right now. Eurozone unemployment hit 12.2 per cent in April, according to Eurostat. In places where the sovereign debt crisis hit hardest, though, unemployment is huge problem. Youth … “Euro Lower as Unemployment Reaches Another High”

Aussie Drops as Commodities Continue to Struggle

Australian dollar is heading lower today, dropping as commodities continue to struggle. With the Federal Reserve on the verge of pulling back its stimulus efforts, and concerns about global growth rising to the top, Aussie is having trouble today. Aussie is near a two-year low today, thanks in large part to the recent commodity slide. Gold prices and oil prices are lower today, and commodities have been struggling for weeks now. … “Aussie Drops as Commodities Continue to Struggle”

USDJPY and S&P Futures – Both Looking Bearish (Elliott

S&P Futures turned around perfectly from that 1655/1660 resistance area that we highlighted several times in our past updates. Notice that the pull-back from 1636 was in three waves that now appears complete after the current new leg down. In fact, we also see a head and shoulders pattern that is pointing for a sizeable … “USDJPY and S&P Futures – Both Looking Bearish (Elliott”

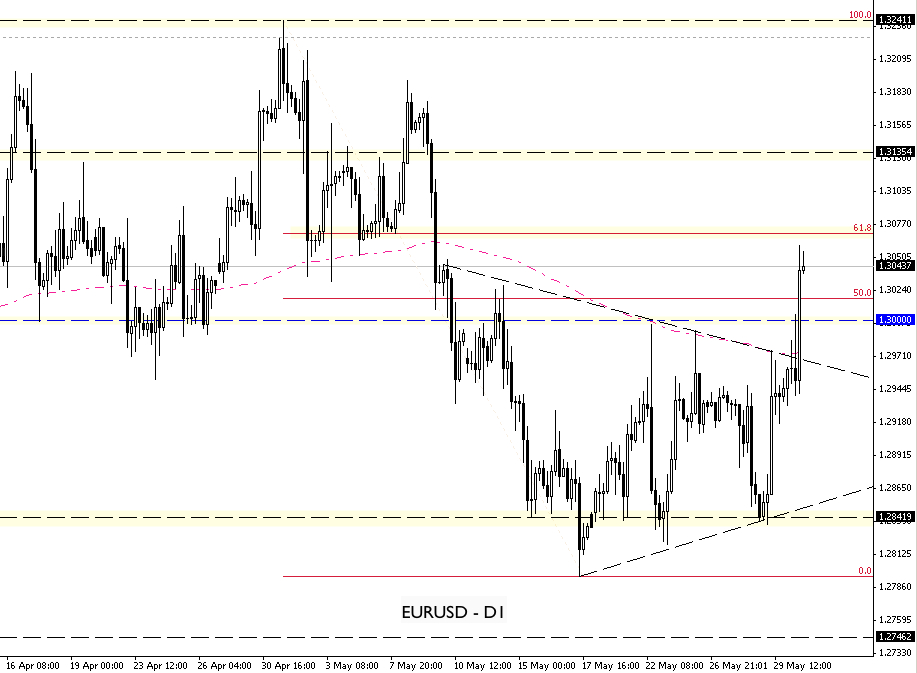

EUR/USD Technical Update May 31 2013

EURUSD has seen a strong breakout above the triangle consolidation pattern as per the attached H4 chart. This has resulted in a break above the 1.3000 round number area and the 50% retrace level. Price is currently consolidating around the 1.3040 area – around 20 pips under the 61.8% Fibonacci retrace level. Guest post by Nick Simpson of www.forex-fx-4x.com … “EUR/USD Technical Update May 31 2013”

FXCM Exercises Option to Purchase Additional 2.25% Convertible Senior

The financial moves by FXCM continue in a busy week for the US based Forex broker. After announcing the Pricing of Private Offering of $150 Million of 2.25% Convertible Senior Notes, the company now announces that the Exercise of Option to Purchase Additional 2.25% Convertible Senior Notes due 2018. More details are available in the press release … “FXCM Exercises Option to Purchase Additional 2.25% Convertible Senior”

Franc Rises as GDP Growth Beats Expectations

The Swiss franc rose today as economic growth in Switzerland exceed analysts’ expectations, attracting investors to the nation’s assets and supporting the currency’s role as a safe haven. Swiss gross domestic product expanded 0.6 percent in the first quarter of 2013 from the previous three months. Market participants have hoped for just 0.2 percent growth. The report said: Positive contributions to growth came from private consumption, investments in construction and from the trade balance, … “Franc Rises as GDP Growth Beats Expectations”

Canadian Dollar Advances as Current-Account Deficit Narrows

The Canadian dollar advanced today against its US peer as the nation’s current-account deficit shrank last quarter, adding to speculations that the central bank may raise interest rate in the future. The currency declined versus the euro. The Canadian current-account shortage narrowed by C$0.5 billion to C$14.1 billion in the first quarter of 2013. Analysts have expected an increase. The positive data added to evidences that the Bank of Canada can withdraw some stimulus without … “Canadian Dollar Advances as Current-Account Deficit Narrows”