Australian GDP is the primary gauge of the production and growth of the economy. It is considered by analysts as one the most important indicators of economic activity, and a reading which is higher than expected is bullish for the Australian dollar. Here are all the details, and 5 possible outcomes for AUD/USD. Published on Wednesday at10:30 … “AUD/USD: Trading the Australian GDP”

Month: February 2016

Higher Oil Prices Aren’t Helping Loonie Much Today

Oil prices are higher today, but that isn’t helping the loonie much. Canadian dollar isn’t showing much improvement today as it loses ground to some of its major counterparts. Oil prices are a little higher today, thanks in part to the fact that a meeting is coming in March to discuss a production freeze for oil. This includes countries inside and outside OPEC. The prospect of tighter production is buoying up … “Higher Oil Prices Aren’t Helping Loonie Much Today”

Inflation Reading Sends Euro Lower in Forex Trading

Euro is heading much lower today, dropping as the latest inflation reading prompts policymakers to talk about easing further at the next ECB meeting. Concerns about the economic recovery of the 19-nation currency region are once again paramount for many traders. The inflation rate in the eurozone is at minus 0.2 per cent, which is lower than the forecast of 0 per cent. Tumbling prices in the 19-nation currency region are weighing … “Inflation Reading Sends Euro Lower in Forex Trading”

GBP/NOK: A Sterling Example

Norges Bank last lowered its Key policy rate 25 basis point to 0.75% in June of 2015 citing “…Developments in the Norwegian economy have been slightly weaker than expected and the economic outlook has deteriorated somewhat… …output growth has edged down and reporting enterprises expect growth to remain weak over the next half-year…” Norway’s economy … “GBP/NOK: A Sterling Example”

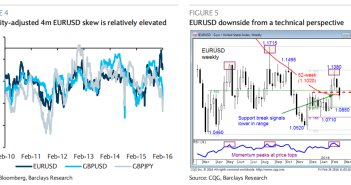

EUR/USD: A Sell; USD/JPY: Targeting 100 – Barclays

What’s next for major pairs? Here are detailed ideas from Barclays: Here is their view, courtesy of eFXnews: EUR: EURUSD – A cheaper alternative to hedge EU referendum risks. We recommend owning EURUSD downside options as a cheaper way to hedge against the EU Referendum risk. We continue to argue that the referendum is at least … “EUR/USD: A Sell; USD/JPY: Targeting 100 – Barclays”

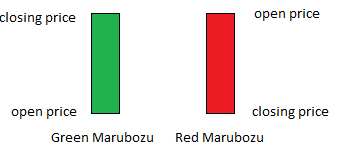

Marubozu candlestick in Technical Analysis

The Marubozu candlestick – Explanation You are probably familiar with Japanese candles and their role in technical analysis. If not, the first thing you need to know is that Japanese candles are commonly used by Forex traders and help them in recognizing price trends and finding good trading opportunities. Today I would like to introduce … “Marubozu candlestick in Technical Analysis”

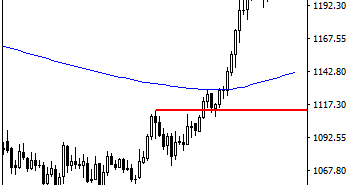

GOLD: Continues To Trade Below Key Resistance

GOLD: With GOLD closing marginally lower on a rejection candle the past week (see weekly chart), further downside is likely. On the downside, support comes in at the 1210.00 level where a break will turn attention to the 1200.00 level. Further down, a cut through here will open the door for a move lower towards … “GOLD: Continues To Trade Below Key Resistance”

5 Tools the ECB has left

It’s ECB week. We know they are going to do something, but what can they actually announce? Here is the toolbox according to Danske: Here is their view, courtesy of eFXnews: We look at what is left in the ECB’s toolbox, how the remaining tools would support inflation and how they would affect markets across … “5 Tools the ECB has left”

Sterling Ends Week as Biggest Loser due to Brexit Fears

The main theme on the currency markets last week was a potential exit of Great Britain from the European Union. Obviously, this led to weakness of the sterling, which has ended the week as the biggest loser among major currencies, though the euro was not immune as well. The start of the week has set the stage for the pound’s drop to multi year lows as the referendum for leaving the EU was announced and the mayor of London stated that he favors … “Sterling Ends Week as Biggest Loser due to Brexit Fears”

Greenback Heads Higher After GDP Reading

US dollar is gaining ground against its major counterparts today after the release of the latest GDP data. An improving US economy is boosting the possibility of a rate hike later this year. After the Federal Reserve raised rates slightly in December, many analysts thought that there wouldn’t be another rate hike for quite some time. Unrest and other problems led to concerns about the economy. However, data … “Greenback Heads Higher After GDP Reading”