Many experts and policymakers are watching today for the announcement that the Chinese yuan (also called the renminbi) will be added to the IMF’s Special Drawing Rights basket. The IMF uses a basket of currencies, called Special Drawing Rights, as a defacto currency. This asset can be used for transactions between the IMF and central banks around the world. Christine Lagarde, the head of the IMF, backs the idea of including the yuan in the basket, and the move is expected … “Chinese Yuan Poised to Join Reserve Currency Basket”

Month: November 2015

Is the Dollar Index About to Reach a New Cyclical High?

US dollar index is higher today, thanks in large part to the continued struggles of the euro. With the dollar index above 100, many are looking to see if it reaches the highs seen last March. There is a lot ahead this week, and much of it could have an impact on the performance of the US dollar and the dollar index. The ECB is meeting this coming week, and expectations for more stimulus could mean … “Is the Dollar Index About to Reach a New Cyclical High?”

EUR/CAD: Full Circle

The Canadian Dollar saw its best against the Euro towards the end of April of this year at $1.31339 vs the Euro. The Loonie had steadily gained against the Euro in the days leading to and following the initiation of its expanded asset purchase program, 9 March. The Bank of Canada had reduced its key … “EUR/CAD: Full Circle”

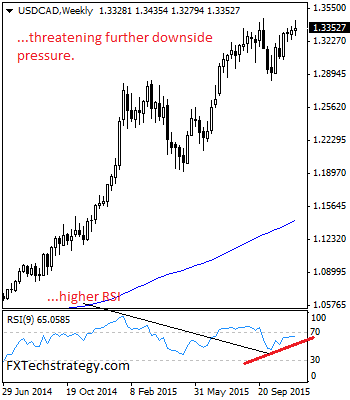

USDCAD Ended The Week Slightly Higher

USDCAD: Having printed a rejection candle ahead of its key resistance located at 1.3435/56 zone, USDCAD ended the week slightly higher. This leaves risk of a pullback in the new week on continued price failure. Its key resistance standing at the 1.3435/56 levels comes in as the next upside target. Further out, resistance comes in … “USDCAD Ended The Week Slightly Higher”

USD/CAD: Trading the Canadian GDP Nov 2015

Canadian GDP is a measurement of the production and growth of the economy. Analysts consider GDP one the most important indicators of economic activity. A reading which is better than the market forecast is bullish for the Canadian dollar. Here are all the details, and 5 possible outcomes for USD/CAD. Published on Tuesday at 13:30 … “USD/CAD: Trading the Canadian GDP Nov 2015”

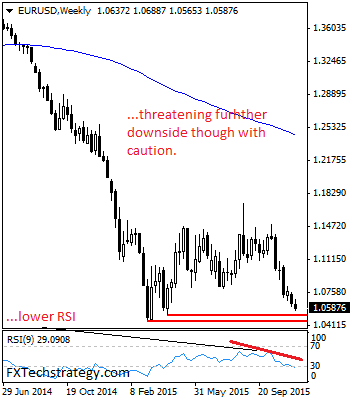

EURUSD Looks To Retarget The 1.0519 Zone

EURUSD: With the pair closing slightly lower the past week, its broader risk points lower to the 1.0519 level. EURUSD looks to retarget the 1.0519 zone which is consistent with its long term downtrend bias. However, a recovery may occur especially now that is approaching its key supports. Support is located at the 1.0500 level … “EURUSD Looks To Retarget The 1.0519 Zone”

Euro, Swiss Franc Still Vulnerable to Central Bank Actions

When we look at activity in the forex markets, most of the attention this year has been focused on the US Dollar as the greenback has risen to new long-term highs against a broad number of world currencies. But forex traders will need to look at other areas of the forex market in order to … “Euro, Swiss Franc Still Vulnerable to Central Bank Actions”

3 ECB Scenarios & EUR/USD reactions – UOB

Tension is growing towards the all important meeting of the European Central Bank. The team at UOB provides a table of scenarios and some explanations to the EUR/USD reactions: Here is their view, courtesy of eFXnews: In a note to clients, UOB Group outlines 3 broad scenarios for the ECB meeting next week that are likely and … “3 ECB Scenarios & EUR/USD reactions – UOB”

The ECB will not disappoint – downward pressure on

EUR/USD has already dipped on higher expectations for what Draghi has in store. The team at BTMU sees further downward pressure and sets a new range for next week: Here is their view, courtesy of eFXnews: The euro is likely to remain under downward pressure against the US dollar heading into the ECB’s upcoming policy meeting … “The ECB will not disappoint – downward pressure on”

The Case For Staying Core Short EUR/USD – ANZ

As we near the ECB meeting, the euro feels the pressure and many think: is it already priced in? The team at ANZ explore EUR/USD and provide a clear answer: Here is their view, courtesy of eFXnews: “The expectation of ECB policy easing has obviously been positive for euro area fixed income markets. Yields on short-dated … “The Case For Staying Core Short EUR/USD – ANZ”