The US dollar continued to experience weakness, demonstrating the second consecutive weekly drop versus the euro and the fourth against the Great Britain pound and the New Zealand dollar. The major reason for this weekly decline was poor economic data from the United States. There were several worse-than-expected macroeconomic reports over the week, but most important of them was the revision of gross domestic product that demonstrated a huge contraction by 2.9 percent … “Terrible US Economic Data Leads to Another Weekly Drop of USD”

Month: June 2014

Indian Rupee Bounces as Rally of Oil Prices Falters

The Indian rupee gained today as falling prices for crude oil eased fears about potential increase of the nation’s trade balance deficit. The currency was heading for a first weekly gain in a month. The rally of crude oil prices faltered on speculations that the conflict in Iraq will not impact supply to a great degree. In fact, Iraqi officials were even promising to increase exports. While prices for crude rose today, they were still … “Indian Rupee Bounces as Rally of Oil Prices Falters”

Euro Continues to See Modest Gains

Even though confidence measures show a decline, the euro continues to see modest gains against some of its major counterparts. The world situation continues to support the safety of the yen, but the euro is higher against the dollar and the pound today. The European Commission released its Economic Sentiment Indicator earlier, and say that there was a drop from 102.6 to 102.0 in May, when many had expected an increase to 103.0. The gain was … “Euro Continues to See Modest Gains”

NZD Drops on Trade Balance, Sill Retains Appeal of Traders

The New Zealand dollar sank today as the nation’s trade balance worsened, though it was better than analysts forecast. Market experts still view the currency in a positive light, saying that fundamentals are extremely supportive. The New Zealand trade balance posted a surplus of NZ$285 million in May, which was bigger than forecast NZ$250 million but far smaller than the previous month’s value of NZ$498 million. On an interesting … “NZD Drops on Trade Balance, Sill Retains Appeal of Traders”

InstaForex adds Autochartist research and analytics

By Mike Fox Russian FX broker InstaForex and Autochartist have teamed up to provide InstaForex’s clients with Autochartist’s research and analytics. InstaForex is an already feature rich broker for retail traders and adding … Source: Leap Rate

Poor US Data Encourages Traders Stick to Safety of Yen

The Japanese yen advanced today, rising versus the US dollar and the euro, and trading little changed versus the Great Britain pound. The Japanese currency profited from worries created by worse-than-expected macroeconomic data from the United States. Personal income of US consumers rose 0.4 percent in May, while spending increased by 0.2 percent. While the data was not bad by itself and better than the previous month’s reading, it was still … “Poor US Data Encourages Traders Stick to Safety of Yen”

BoE Mortgage Limits Do Not Threaten UK Economy, GBP Gains

The Great Britain pound gained today as experts speculated that the measures, introduced by the central bank to reduce the number of riskier mortgages, will not derail economic recovery of the United Kingdom. The Bank of England believes that the recent housing boom was caused by risky loans, and “this could pose direct risks to the resilience of the UK banking system”. As a result the Financial Policy Committee recommended to the Prudential Regulation Authority (PRA) and the Financial Conduct Authority … “BoE Mortgage Limits Do Not Threaten UK Economy, GBP Gains”

Greenback Gains Ground Against Euro After Jobless Claims

US dollar is up against the euro today, gaining ground after the jobless claims report. While the report missed expectations by a little bit, the general trend is still toward economic recovery, and the rising dollar index reflects that today. The latest weekly jobless claims data is in, and initial claims fell by 2,000, dropping to a seasonally adjusted 312,000. Expectations had been to drop to 310,000, though. Even though … “Greenback Gains Ground Against Euro After Jobless Claims”

Euro Loses Ground on Economic Comparisons

Euro is heading lower today, after a few days of small gains. Economic comparisons are being made again, and the euro appears to have the short end of the stick. Forex traders are considering economic data again, and the eurozone continues to appear weak in comparison to other major economies. Euro is down against most of its major counterparts today, pulling back as some Forex traders take profits and as policy divergence … “Euro Loses Ground on Economic Comparisons”

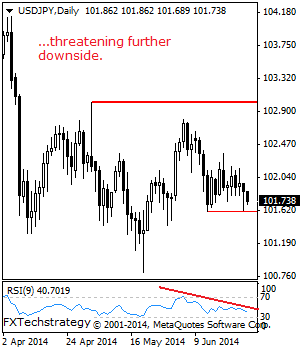

USDJPY: Faces Downside Pressure

USDJPY: With USDJPY weakening further on Wednesday, it faces additional bear risk. On the upside, resistance resides at the 102.50 level. A break of here will expose the 103.01 level where a breach will create scope for a run at the 103.50 level. Further out, resistance is seen at the 104.00 level and then the … “USDJPY: Faces Downside Pressure”