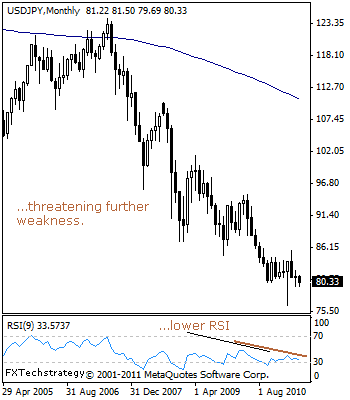

USDJPY: Outlook Lower With Eyes On The 76.18 Level (Monthly Outlook)

USDJPY – Having followed through lower on the back of its flat close in May 2011, further bear pressure looks to push USDJPY towards its 2011 low at 76.18.

With corrective attempts rebuffed at the 85.52 level in April followed with continued downside pressure, a break of the 76.18 level could trigger further declines. In such a case, the 74.00 level and the 72.00 level, representing its psycho levels will be targeted.

Guest post by www.fxtechstrategy.com

Its monthly RSI is bearish and pointing lower suggesting further weakness. On the upside, the pair will have to close above the 85.52 level to reverse its present bear threats and bring further gains towards the 89.15 level, its July’2010 high.

Further out, a break of that level will allow for more gains towards the 91.58 level, its April 19’10 low and subsequently the 94.97 level.

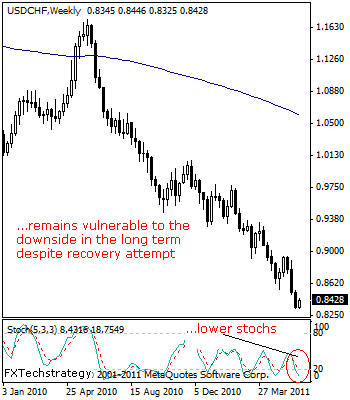

USDCHF: Triggers Corrective Recovery, Closes Higher (Weekly Outlook)

USDCHF: The pair may have halted its broader declines at the 0.8325 level and closed higher for the week but continues to hold its bearish long term downtrend.

On continued corrective recovery, USDCHF could push further higher towards its May 04’2011 low at 0.8551 where a reversal of roles as resistance is expected to occur and turn the pair back down.

Another resistance is located at the 0.8746 level, its May 20’2011 low and possibly higher. Alternatively, support lies at the 0.8325 level, its 2011 low where a decisive violation will open the door for more declines towards the 0.8300 level, representing its psycho level.

A turn below this level will set the stage for a push further lower towards the 0.8200 level and the 0.8100 level, marking its psycho levels. The psycho levels (00) become necessary without clear price supports.

Its weekly stochastics is bearish and pointing lower suggesting further weakness.