Euro is forming a short covering rally after the some powerful downward reaction at the end of the past week, which is quite interesting after S&P downgraded Greece to negative CCC outlook. In normal circumstances you would expect a Euro sell-off, but technical always win, very similar and contrary reaction that was already seen in the past week, during the ECB press conference.

Our outlook for the Euro remains bearish as we believe that a decline from 1.4699 is an impulse followed by a current bounce higher that should be corrective recovery, labelled as a black wave B/2.

Guest post by Gregor Horvat

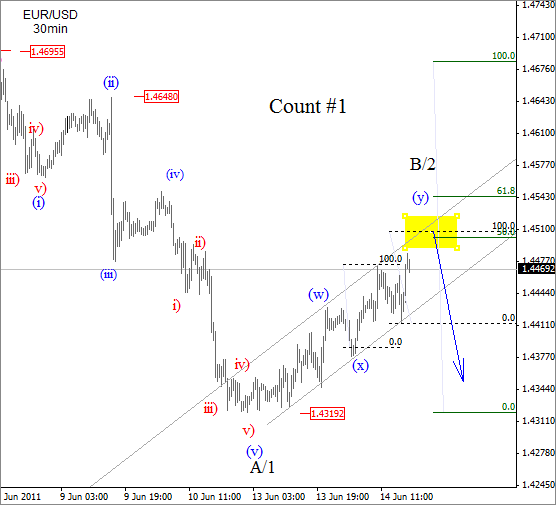

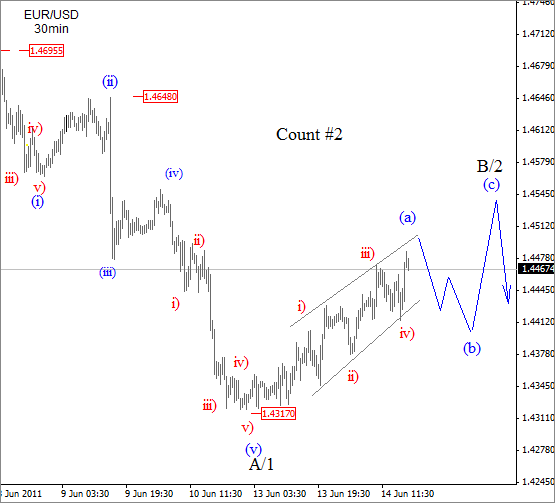

On the Intra-day basis we are monitoring two different wave counts:

The first one shows a double zig-zag in wave B/2 which in fact should be trading in late stages of that move.

Count #1:

Count #2:

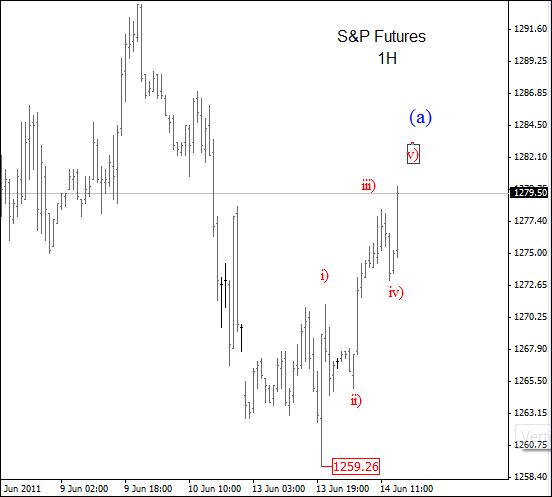

However, you may noticed that on both counts, prices are headed into huge resistance around 1.4500/50, but because of the S&P futures which bounced higher in five small waves from 1259, we favor the wave count number two!

S&P Count:

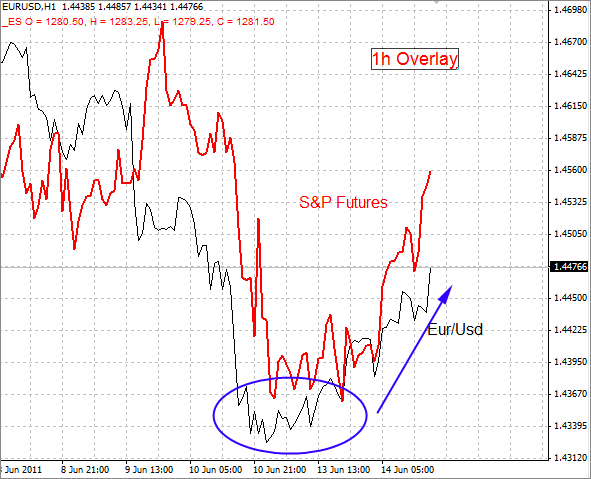

Also another thing, just look at this S&P Futures/Euro overlay chart.

For more analysis visit us at www.ew-forecast.com/ and try our services with special offer 2for1. Get 2 Months for price of 1Month .

*EXPIRES on Tuesday June 14th 2011 at 23:59EDT