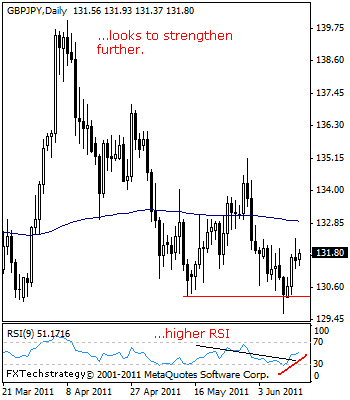

GBPJPY: Maintains A Recovery Tone.

GBPJPY – While GBPJPY has halted its weakness started from the 140.02 level in early April’2011, it requires further strength to prevent a return to the 129.68 level, it June 12’2011 low.If this happens, GBPJPY will strengthen further towards its daily 200 ema at 132.94 with a violation of that level allowing for further gains towards the 135.09 level, its May 31’2011 high.

Further down, a turn below that level if seen will open the door for more gains towards the 136.97 levels, its April 28’2011 high where a break will signal a return to its 2011 high at 139.99 level and then the 142.00 level. Its daily RSI is bullish and pointing higher suggesting further gains.

Guest post by www.fxtechstrategy.com

Alternatively, the risk to our bullish view will be a return below 129.68 level. This will set the stage for further weakness towards the 127.52 level, its Mar’13’2011 low and possibly lower.

All in all, GBPJPY is struggling to strengthen further following a recovery triggered from the 129.68 level.

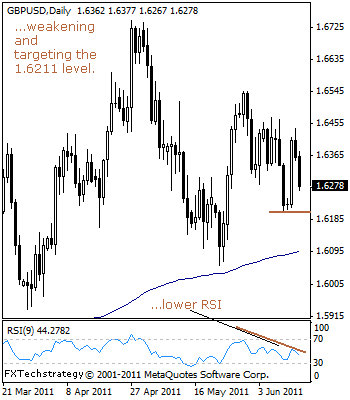

GBPUSD: Loses Momentum, Eyes Further weakness.

GBPUSD: The pair has backed off higher prices and is presently weakening for a second day in a row.

With the price action taking back most of its rally gains off the 1.6211 level, a return to the that level cannot be ruled.

Below there will clear the way for a move further lower towards the 1.6105 level, its May 18’2011 low and probably lower towards the 1.6000 level, its major psycho level. Its daily RSI is bearish and pointing lower suggesting further declines.

Conversely, GBP will have to climb back above the 1.6546 level, its May 31’2011 high to prevent a return to the 1.6211 level, its Friday low. Above the 1.6546 level will call for a run at the 1.6743 level, its 2011 high and then the 1.6877 level, its Nov’2009 high.

A loss of the latter level will pave the way for further strength towards its bigger resistance at the 1.7039 level, its 2009 higher.