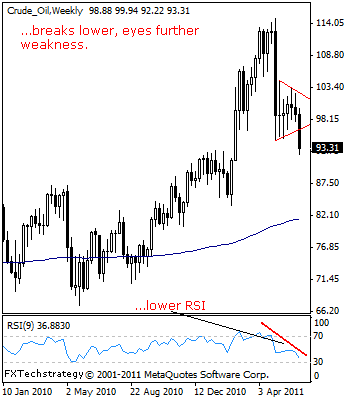

CRUDE OIL: Breaks Out Of Symmetrical Triangle.

CRUDE OIL: The commodity’s continued struggle to form a bottom ended the past week following a break out of its triangle pattern pushing it through the 94.63 level.

This technical development has left Crude Oil targeting further declines towards its Feb 21’2011 low at 91.27 with a break below that level allowing for more weakness towards its long term rising trendline dating back to 2009 at 87.27.

Guest post by www.fxtechstrategy.com

Its weekly and daily RSI are bearish and pointing lower supporting this view.

Conversely, on any corrective recovery, its eroded support at 94.63 should reverse roles and provide resistance.

Further out, a decisive violation of the 104.41 level, its May 11’2011 high must occur to end its present weakness and then open the door for more strength towards the 106.50 level and its psycho level at 110.00.

GBPCHF: Pressure Builds On The 1.3612 Level.

GBPCHF – Although consolidation continues to dominate the cross’s price action, it looks to return below the 1.3612 level, its Jun 13’2011 low unless a climb back above its Jun 15’2011 high at 1.3905 occurs.

GBPCHF remains vulnerable and is present weakening suggesting a break of the 1.3612 level will resume its long term downtrend towards the 1.3500 level and 1.3400 level, all representing its psycho levels.

A breach of the latter level will call for a run at the 1.3300level. Its weekly and daily studies are bearish and pointing lower signifying further weakness.

On the upside, key resistance stands at the 1.3905 level, its Jun 15’2011 high with a turn above there setting the stage for further strength towards its May 31’2011 high at 1.4119.

A cap is likely to occur and turn the cross back down in the direction of its primary trend if tested.