Euro reversing from its highs, as stocks found some sellers during the FOMC Press Conference. US dollar was mostly stronger, but Canadian dollar was acting quite well during this time. As such, we looked at some crosses, and Eur/Cad should be really interesting. We are expecting a rise of Canadian dollar against the Euro even if dollar rises against Euro and Canadian dollar at the same time.

Guest post by Gregor Horvat

Eur/Cad technical comments:

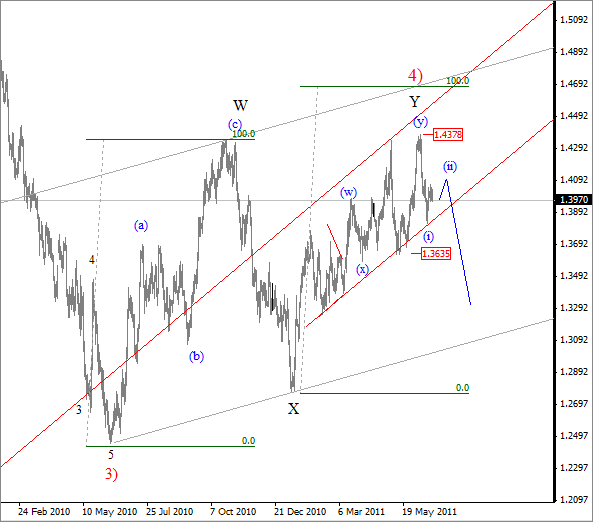

A bounce from June 2010 lows; exactly one year back, cannot be counted impulsively. So if its not impulse, then we know its corrective move, a double zig-zag pattern; W-X-Y as labelled on the chart! With this being said, we believe that Long-term trend is down, so long-term investors should look for shorts on that pair, rather than longs.

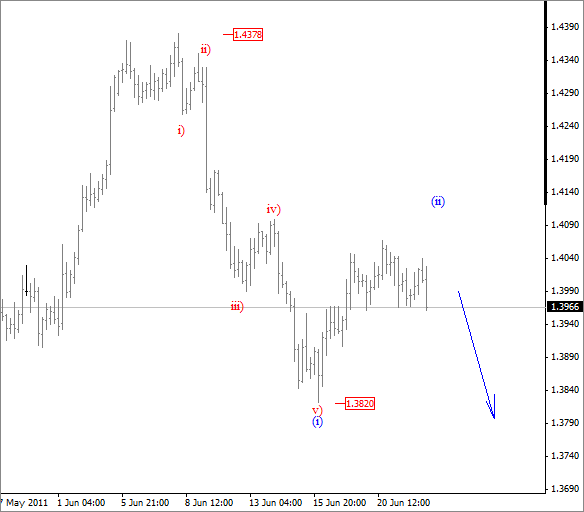

In fact, if we take a look on the next 4h chart, then we can see a five wave decline from 1.4378 highs, called an impulse where wave iii) is the longest, and waves iv) and i) do not overlap!. Elliott Wave theory says that impulsive waves shows direction of a temporary trend, which is down, and should continue, once corrective wave (ii) bounce from 1.3820 completes.

Generally speaking, pair should reach levels well below 1.382, while highs from early June are in place.

Do you like our analysis!? For more visit us at http://www.ew-forecast.com/

Follow us on twitter.