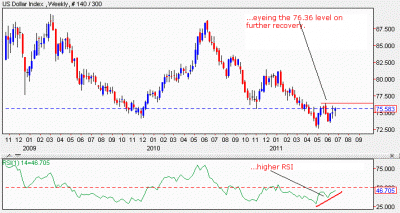

Dollar Index: Recovery Sets Up For 76.36 Level.

US Dollar Index: With a third week of recovery strength seen the past week, further bull pressure is likely to continue in the new week.

The Index’s present offensive is coming on the back of a halt in its long term declines at the 72.62 level in early May’2011 and its subsequent recovery higher.

While the immediate risk remains to the upside, a convincing break and hold above the 76.36 level, its May 2011 high will have to occur to prevent a return below the 72.69 level. Further out, resistance lies at the 77.38 level.

Guest post by www.fxtechstrategy.com

Its weekly RSI is bullish and pointing higher suggesting further strength.

Alternatively, a return below the 72.69 level will if seen will annul its present upside recovery and bring further weakness towards the 71.509 level, its July 2008 low and subsequently its 2008 low at 70.79.

All in all, although the Index remains biased to the upside in the immediate term, its overall long term outlook remains to the downside.

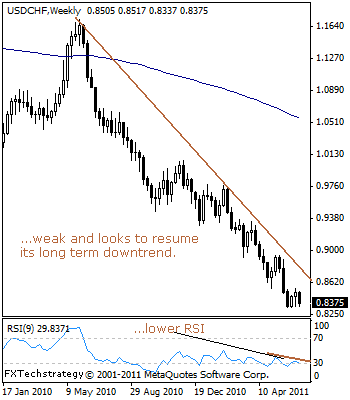

USDCHF: Threatening To Resume Long Term Downtrend.

USDCHF: With a reversal of almost all of its two-week gains seen the past week, risk of resuming its long term downtrend is now looming.

For USDCHF to trigger its trend resumption, a decisive violation of its 2011 low at 0.8325 will have to occur.

This will set the stage for further weakness towards the 0.8300 level, representing its psycho level with a turn below this level paving the way for a push further lower towards the 0.8200 level and the 0.8100 level, marking its psycho levels.

Its weekly RSI is bearish and pointing lower suggesting further weakness. Alternatively, the pair will have to return above the 0.8551 level, its Jun 15’2011 high to prevent the above scenario from playing out. In such a case, further upside gains will shape up towards the 0.8746 level, its May 20’2011 low and possibly higher.

All in all, USDCHF remains vulnerable to the downside in the long term as it looks to recapture the 0.8325 level and trigger that trend.