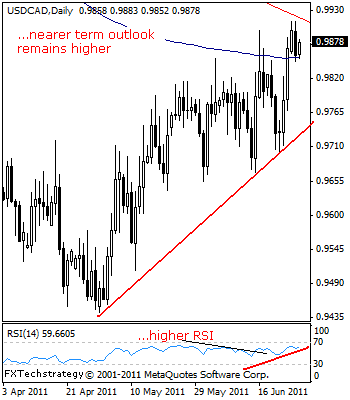

USDCAD: Consolidating With Upside Bias

USDCAD: Price hesitation may have set in ahead of its long term falling trend line but USDCAD continues to maintain its overall short term upside.An attempt on the mentioned trendline is likely on ending its present hesitation.

A convincing violation of that level will call for further strength towards the 0.9969 level, its Mar 15’2011 high. This level may present a tough resistance but if it is eventual broken, the pair will aim at its Jan 31’2011 high at 1.0057.

Guest post by www.fxtechstrategy.com

Its daily RSI is bullish and pointing higher supporting its present bull pressure. On the downside, the risk to this view will be a return below the 0.9654/69 levels, its May 31’2011/Jun 15’2011 lows.

This zone should hold and turn the pair back up if tested, but if it fails, further bear threats should follow towards its May 11’2011 low at 0.9512.

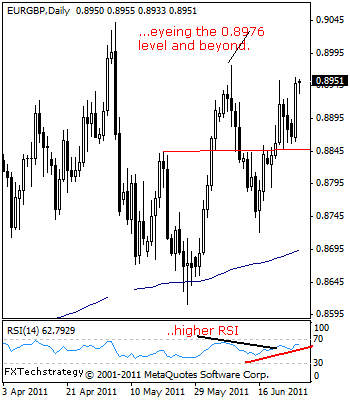

EURGBP: Reversal Of Gains Turns Focus To The 0.8976 Level.

EURGBP- A strong rally during Monday trading session saw the cross reversing its three-day corrective weakness and turning focus to the 0.8953/76 levels, its Jun 08/22’2011 highs.

Beyond that zone will pave the way for more gains towards the 0.9040 level, its May 05’2011 high and possibly higher towards the 0.9150 level.

Its daily and weekly RSI are bullish and pointing higher supporting this view. On the other hand, the risk to our analysis will be a return below the 0.8720 level, its Jun 16’2011 low though not likely at its present price levels.

However, if seen it will create scope for further declines towards the 0.8610 level, its May 26’2011 low.

All in all, the cross has reversed its three-day losses and turned attention to the 0.8976 level and beyond.