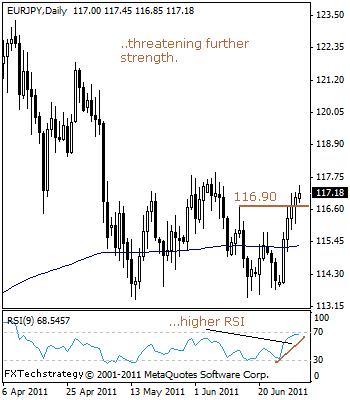

EURJPY: Holds On To Recovery Tone, Aims At The 117.90 Level.

EURJPY- Our outlook remains higher on EURJPY for further corrective recovery. With continued hold on to most of gains triggered from the 113.49 level, further strength should build up towards the 117.90 level, its Jun 07’2011 high.

A strong foothold above the 117.90 level must be established to avert a return below its Jun 16’2011 low at 113.42. This will set the stage for further gains towards its April 26’2011 low at 118.50 and possibly higher towards 121.83 level.

Guest post by www.fxtechstrategy.com

Its daily RSI is bullish and pointing higher suggesting further gains. However, on any pullback, the 116.70 level, its Jun 14’2011 high will be targeted ahead of 114.78 level, its Jun 21’2011 high.

Below there if seen will call for a further push lower towards its .618. Fib Ret (106.69-123.39 rally) at 112.97 and followed by the 110.80 level, its Mar 18’2011. All in all, the cross continues to keep its recovery tone set from the 113.49 level suggesting further price extension.

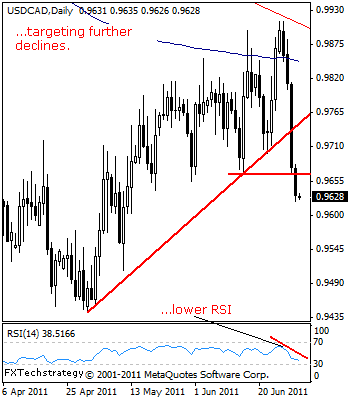

USDCAD: Bearish Momentum Remains Intact.

USDCAD: The pair looks set to end the week lower having broken and held below its rising trendline dating back to May 01’2011 low (0.9442).

With a break below the 0.9654/69 levels, its May 31’2011/Jun 15’2011 lows occuring on Thursday, risk of further weakness cannot be ruled out.

Further down, support lies at its May 11’2011 low at 0.9512 and ultimately, the 0.9442 level, its 2011 low. Its daily RSI is bearish and pointing lower supporting this view.

Alternatively, for the pair to annul its present weakness, it will have to return above the 0.9912 level seen on Jun 27’2011 and its broken long term falling trendline support currently at 0.9922.

Further out, resistance stands at the 0.9969 level, its Mar 15’2011 high and then its Jan 31’2011 high at 1.0057. All in all, USDCAD remains biased to the downside on further corrective weakness.