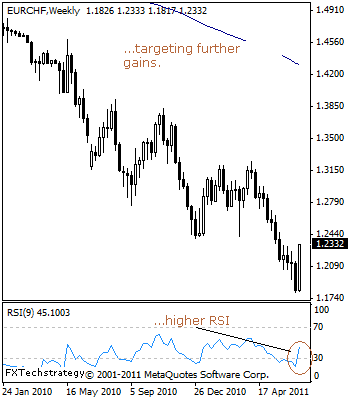

EURCHF: Rallies Sharply, Bullish Into The New Week.

EURCHF – Outlook on EURCHF remains to the upside nearer term after reversing its three-week gains to close at 1.2332 at the end of the week.

This is coming on the back of a halt of its broader weakness and a rally off the 1.1805 level, its 2011 low.

With that said, further upside gains is expected to follow through higher in the new week with the next resistance standing at the 1.2468 level, its Mat 24’2011 high.

Guest post by www.fxtechstrategy.com

Further out, resistance comes in at the 1.2646 level, marking its May 20’2011 high. Its weekly RSI is bullish and pointing higher suggesting further gains.

Alternatively, the cross will have to return below the 1.1805 level to annul its present bullish offensive and bring further weakness towards the 1.1700 level and the 1.1600 level, all representing its psycho levels.

All in all, with the cross recovering strongly higher the past week, further gains are expected in the new week.

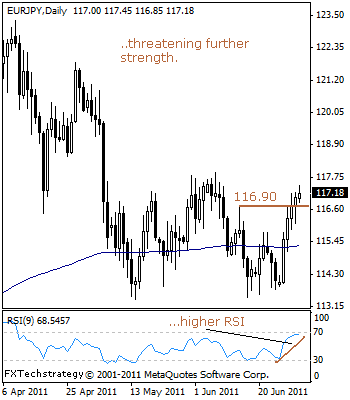

EURJPY: Holds On To Recovery Tone, Aims At The 117.90 Level.

EURJPY- Our outlook remains higher on EURJPY for further corrective recovery.

With continued hold on to most of gains triggered from the 113.49 level, further strength should build up towards the 117.90 level, its Jun 07’2011 high.

A strong foothold above the 117.90 level must be established to avert a return below its Jun 16’2011 low at 113.42.

This will set the stage for further gains towards its April 26’2011 low at 118.50 and possibly higher towards 121.83 level.

Its daily RSI is bullish and pointing higher suggesting further gains. However, on any pullback, the 116.70 level, its Jun 14’2011 high will be targeted ahead of 114.78 level, its Jun 21’2011 high.

Below there if seen will call for a further push lower towards its .618. Fib Ret (106.69-123.39 rally) at 112.97 and followed by the 110.80 level, its Mar 18’2011.