Standard and Poor’s downgraded the U.S.’s sovereign credit rating from AAA to AA+ on Friday after the market close. There are a lot of speculations how the markets will react, which should be US dollar negative. Now, the question is where the money will go!? We believe it will be nothing different compared to what we saw in the past week. Swiss franc and gold should rally as safe-haven investments! The Japanese yen will also not be an exception, but gains on that one may quickly slow down because of possible intervention speculations.

Some one would also have think on commodity currencies, such as Australian, New Zealand and Canadian dollar, but because of very tight correlations to commodity and stock markets that are falling; so we don’t think that those currencies will be a good choice however! Technicals are also showing negative trend on those, so its better to avoid them at this point.

Guest post by Gregor Horvat

G-7 will meet up today through the conference call, and will discuss about Europe’s sovereign-debt crisis and a cut in the US credit rating. But what they will really try to do here is to calm down the markets and move investors away from a potential “fear factor”, which will not last long however.

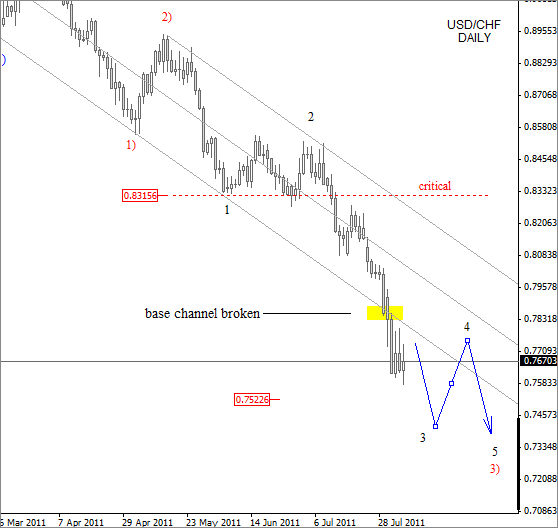

Below is a technical chart of Usd/Chf where we are monitoring a third wave of decline from 0.853. Remember, third wave i s usually the strongest and longest wave in an impulsive sequence, so wave 3 bottom could be much lower.

USD/CHF Daily chart

For more analysis visit us at http://www.ew-forecast.com/

Follow us on twitter.