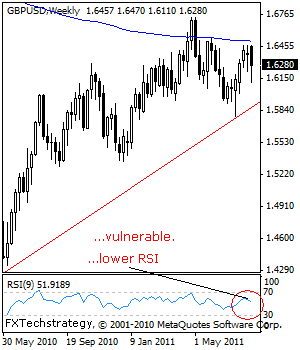

GBPUSD: Risk Higher Above Rising Trendline

GBPUSD: Our outlook on GBP continues to point higher as long as it holds above its long term rising trendline dating back to May’2011.

Although it weakened and closed lower for the week, we see the risk of returning above the 1.6472/1.6510 levels a possibility.

In such a case, the 1.6546 level, its May 31’2011 high will be targeted with a clearance of this level creating additional strength towards the 1.6743 level, its 2011 high and then the 1.6900 level, its psycho level.

Guest post by www.fxtechstrategy.com

Alternatively, on a follow through lower on the back of its past week weakness, the 1.6262 level and the 1.6110 level will come in as the next downside targets.

However, the major barrier on further decline if seen stands at the 1.5846 level, its trendline bottom and 1.5778 level, its July’2011 low. Further down, support is seen at the 1.5700 level, its psycho level.

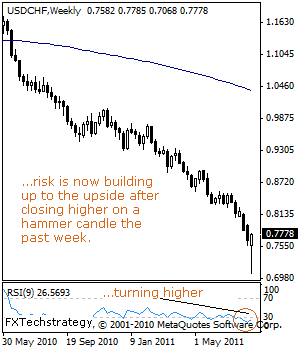

USDCHF: Turns Higher On Hammer & Oversold Condition.

USDCHF: The pair has halted its broader weakness and triggered a corrective recovery on a hammer candle formation the past week.

The implication of this candle formation is that it is a bottom reversal pattern suggesting a temporary bottom is now in place. However, the big challenge is for USDCHF to follow through higher in the new week on the mentioned hammer.

In such a case, its Aug 01’2011 high at 0.7952 will be targeted at first with a breach of that level calling for further strength towards its July 13’2011 low at 0.8079.

We expect a reversal of roles as resistance to occur at this level and turn the pair back lower in the direction of its long term uptrend.

Though its weekly RSI is turning higher, it remains in an oversold zone. Alternatively, the risk to our recovery scenario will be a return below its hammer candle formation bottom at 0.7068.

If this occurs, we could see further declines shaping up towards its big psycho level located at the 0.7000 level. This level could provide a strong support on an initial test and turn the pair back up on a corrective recovery.