The Australian dollar strengthened as the minutes of the central bank’s policy meeting showed that the policy makers are content with the current level of the interest rates, reducing probability of a borrowing costs cut. The Reserve Bank of Australia was less dovish than market participants expected, returning appeal of the Australian currency to carry traders, who profit for the relatively high interest rates in Australia compared to the rates in the developed nations. The RBA was moderately optimistic … “RBA Minutes Don’t Speak About Rates Cut, AUD Rises”

Month: September 2011

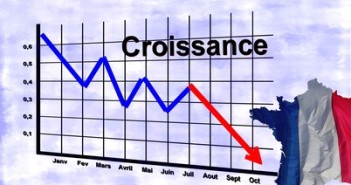

IMF Lowers Growth Forecast for Canada

The Canadian dollar weakened as the International Monetary Fund cut its growth forecast for Canada, making the growth-related nation’s currency less attractive for investors. The IMF revised its growth estimate to 2.1 percent from the June forecast of 2.9 percent. The outlook worsened because of the slower global economic growth and the faltering economic recovery of Canada’s major trading partner — the United States of America. The downgrade of Italy’s credit rating by Standard and Poor’s also … “IMF Lowers Growth Forecast for Canada”

NZD/USD: Trading the New Zealand GDP September 2011

The Gross Domestic Product (GDP), is a quarterly index which measures the production and growth of the economy. Analysts consider GDP one of the most important economic indicators, thus the publication of the New Zealand GDP may well have a critical effect on NZD/USD. Here are all the details, and 5 possible outcomes for NZD/USD. … “NZD/USD: Trading the New Zealand GDP September 2011”

Market Direction To Become Clearer After Wednesday

Christopher Vecchio, a currency analyst with DailyFx.com discusses the upcoming FOMC meeting and sees a small chance for big move. He analyzes the impact on commodity currencies, oil and gold and sees a negative outcome for them. Vecchio also discusses the situation in the euro zone and lays out an option of a split with … “Market Direction To Become Clearer After Wednesday”

Ringgit Falls as Europe Damages Growth Prospects for Asia

The Malaysian ringgit fell today as concerns about the troubles in Europe hurt the outlook for the economic growth in Asia and reduced appeal of the emerging market currencies. The yesterday’s cut of Italy’s credit rating by Standard and Poor’s spurred risk aversion on markets, reducing demand for assets of emerging economies. The Bloomberg-JPMorgan Asia Dollar Index dropped to the lowest level in six months. The Asian Development Bank cut this year’s growth forecast for Asia (with the exception of Japan) … “Ringgit Falls as Europe Damages Growth Prospects for Asia”

FXCM Sponsors the CNBC Million Dollar Portfolio Challenge

US Forex Broker FXCM enhances the cooperation with CNBC and will now sponsor the One Million Dollar Portfolio Challenge – a virtual trading contest where each participant get 1 million virtual dollars and can trade currencies as well as stocks. FXCM already sponsors CNBC’s Money in Motion Currency Trading TV show. With current stock market performance, will … “FXCM Sponsors the CNBC Million Dollar Portfolio Challenge”

USD/JPY: Trading the Existing Home Sales Release

The Existing Home Sales Report is an important economic indicator, considered by analysts as a good measure of consumer demand in the housing sector. As a house is likely to be the largest purchase that a consumer will make, this indicator provides critical data about the mood of consumers and the health of the economy. … “USD/JPY: Trading the Existing Home Sales Release”

Swissie Weakens on Speculation About SNB Intervention

The Swiss franc fell against all but one of most-traded currencies today as Forex traders speculated the Swiss National Bank may adjust the set trading range for the franc in order to support the nation’s exporters. The SNB imposed the ceiling of 1.20 francs per euro on September 6 to support the exporters and protect the nation’s economy from the excessive currency’s strength. The central bank said “it is prepared to buy foreign currency in unlimited quantities”. … “Swissie Weakens on Speculation About SNB Intervention”

Leverate Introduces Improved Client Reporting Interface

Leverate, which provides tools for forex brokers, launches significant upgrades to the client interface integrated with MT4 and other platforms in their Private Label offerings. The company, which got an investment from Saxo Bank, continues to work hard to enahcne their products. Leverate hopes that this new interface will allow liquidity providers to become more … “Leverate Introduces Improved Client Reporting Interface”

Societe Generale Behind Siemens’ Withdrawal

The German corporation Siemens withdrew 500 million euros from Societe Generale according to sources. This happened before the stress tests. This money was withdrawn at the beginning of July. The latest reports from Societe Generale are from the end of Q2, and point to a leverage of 28:1 according to the bank’s internal calculations. How … “Societe Generale Behind Siemens’ Withdrawal”