Both Asian and European markets moved higher after positive sentiment seen at the close of the New York session on Friday. Despite a gap lower on Eur/Usd and Aud/usd at yesterdays open that appeared because of the “no real news from weekends EU summit”, pairs managed to recover on hopes that by Wednesday final decisions will be made.

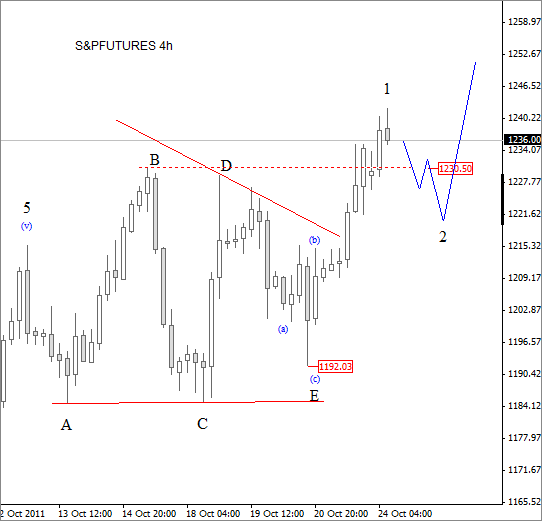

From a technical perspective, the RISK appetite may easily continue in this week, after Weekly/Fridays close above 1230 mark on the S&P Futures. A running triangle is considered as finished, so more gains to come while 1192 holds. Based on this outlook, “Risk currencies”, such as Eur, Aud, Cad, Chf, and Gbp should also extend the gains, as corrective “B” patterns also show sign of a completion on the FX.

S&P Futures chart:

Guest post by Gregor Horvat

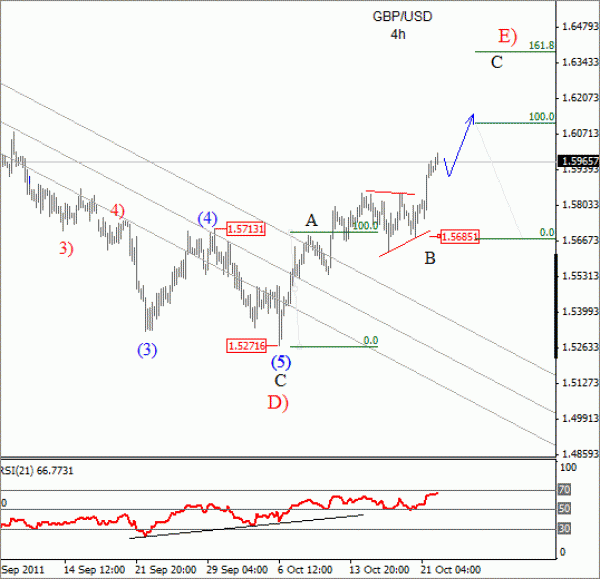

Gbp/Usd Technical review:

As expected, cable moved into a new high in the past few sessions, with quite powerful break out of a triangle consolidation, which means that wave B is complete, and wave C underway. Wave B as we can see, found the lows around 1.5685, so as long this level holds, we will be looking up, towards 1.61, followed by even 1.63, where wave C equals to A!

For more analysis visit us at www.ew-forecast.com or follow us on twitter.