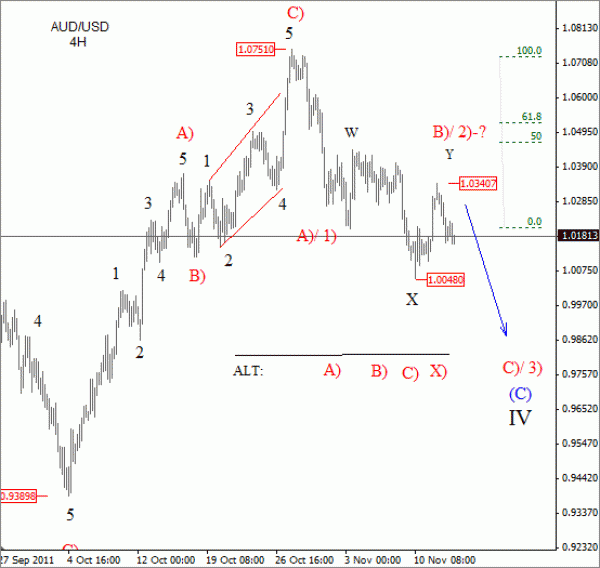

After a rise from the 1.0048 area seen at the end of the past week, we came out with an irregular formation in wave B)/2). As such, our bias remains clearly to the downside. In fact, wave B)/2) may have already found a pick around 1.0340 if we consider impulsive fall on the intra-day basis .

But keep in mind that we are in choppy period of trading, so only price can confirm a downtrend, which means we need 1.0050 breakout when prices should accelerate down to 0.99!

Guest post by Gregor Horvat

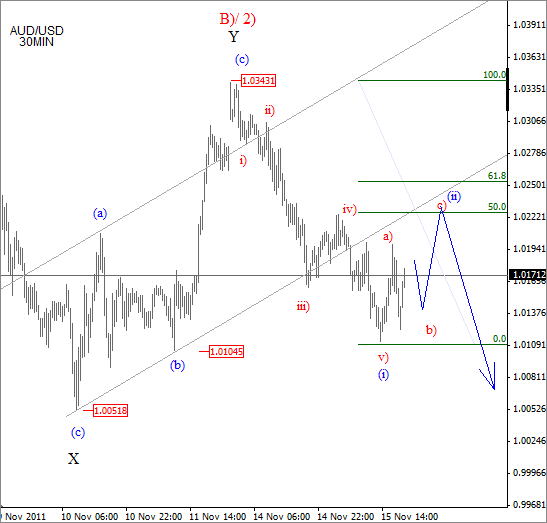

On the 30min chart we can count minor five waves down from 1.0343 pick. As such, recovery from the most recent swing low should be a corrective wave, primary labeled as wave (ii) on the chart. If that will prove correct, then we know that we need a corrective personality, which means a slow, maybe choppy, but definitely 3-wave, a)-b)-c) bounce that should find resistance ideally between 50.61.8% retracement area from where we expect a bearish reversal!

Critical/invalidation level at 1.0343; as long this level holds bias are to the downside!

Join us to today and get timely and accurate analysis now!Or you can follow us on twitter