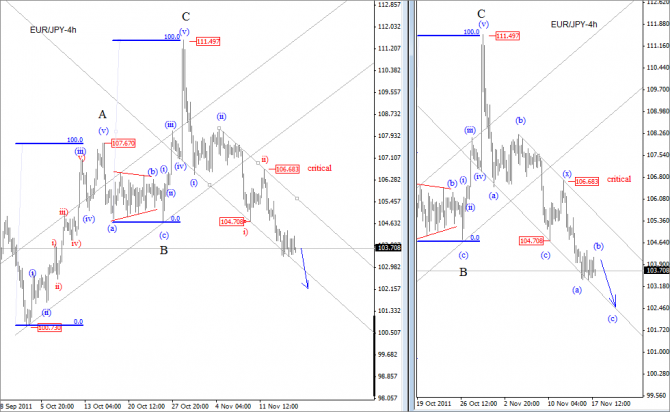

EUR/JPT moved significantly lower from start of November, as three-wave of recovery from 100.70 found the pick at 111.50 region, where C wave was equal to wave A almost on pip!

When an impulsive decline occurred two weeks back from top and then price action slowed down for a few days, we warned our subscribers that this is just a first leg of three down, which were our minimum expectations at that time.

Since then pair fell nicely, another 340 pips into the 104.70 region. But notice that this level was broken, so now we actually have five legs down from November highs, so we count the move as one-two one-two extremely bearish set-up.

Click to enlarge:

Guest post by Gregor Horvat

But even if you count the move correctively from the top, the downtrend is incomplete! Why? Because corrections are never structured in five waves, so even if we count it as a double zig-zag the bearish trend is incomplete!

For more detailed analysis, you can also review video that was recorded for subscribers at that time.

If you like our analysis, and if you would like to join our services, register http://www.ew-forecast.com/. You can also contact us for Special Trial offer on [email protected]

Follow us on http://twitter.com/gregahorvatfx

Video: