Trading volume is thinning down towards the holiday season that marks the end of the year and it’s a good time to look back at movements of currencies in the past year. The fable of the tortoise and the hare seems appropriate to describe this year.

The most volatile currency pairs had quite a limited net movement, while the slower moving and sometimes frustrating pairs scored made bigger gains. This is how it looks:

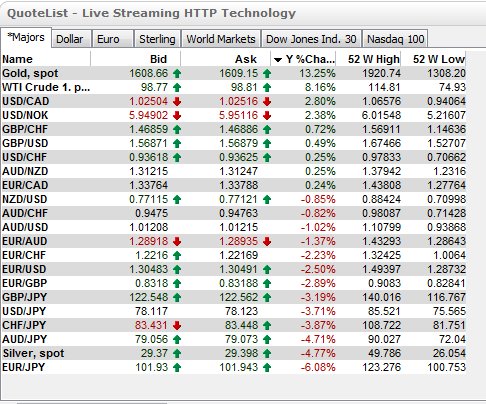

Quote List by Netdania

Among major and minor currency pairs, the biggest gains were seen in USD/CAD, 2.80% at the time of writing. This is a pair that moves in a choppy manner.

Looking at the other side of the graph, the biggest loser is USD/JPY, with a loss of 3.71%. Dollar/yen is far more frustrating, sometimes bound to very tight ranges. In the fable, the tortoise races slowly, but doesn’t stop.

These tortoises made persistent moves even if they were slow.

What about the volatile pairs? AUD/USD certainly one of them – it often makes wild moves. Well, it currently posts a loss of only 1%. Also neighboring NZD/USD made a similar limited move, of less than 1%, despite making big moves and setting record highs during the year.

The same goes for USD/CHF – a gain of only 0.25% at the moment. This pair already dug very low during the year, but the net change is almost non-existent.

These hares eventually ran on the treadmill and didn’t go very far.

EUR/USD, the most popular currency pair, is heading for an annual loss, currently 2.5%. The ongoing debt crisis eventually took its toll, even though the euro was quite resilient against the dollar (with QE2 weakening the greenback) and also against other currency pairs.

GBP/USD remained a bit more volatile in comparison with EUR/USD, but not as wild as it used to be and the current net movement is very small, less than 1%.

Crosses and metals

Looking beyond majors and minors, we can see that gold is biggest winner, with over 13%. It already gained much more during the year. Silver is on the other end, as one of the bigger losers. WTI Crude Oil is on the winners side.

The yen crosses stand out as big losers and this can be explained by risk aversion: as fear took over, the yen strengthened, also against the other safe haven currency, the US dollar. The “risk currencies”, such as the Aussie and the troubled euro lost to the dollar, so they eventually lost more to the yen.

Things can still change until the final hours of 2011, but the general picture isn’t likely to be different.

Will this scenario repeat itself in 2012?

Before we look into 2012, here are more conclusions for 2011:

- 11 Most Popular Articles for 2011

- 30 Sites to Thank and Recommend