Commodities are trading lower this week, while the US dollar is rising sharply after a reversal lower of equities. One of the very weak markets is also gold, which definitely does not have a status of a safe-haven at this point of time.

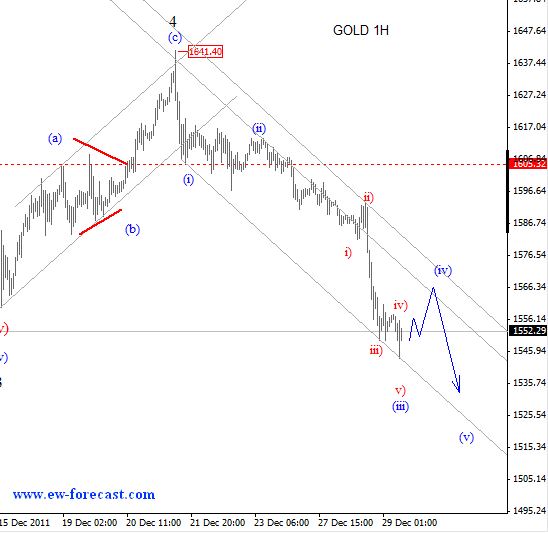

In fact, if we take a look on the intra-day sub-structure from 1641 high, then we can see some sharp bearish moves, which seems to be an impulsive pattern, but likely incomplete.

From an Elliott Wave perspective, we believe that yesterdays sharp decline was wave three, so any bounce in the near-term will be only another corrective leg; wave four of an impulsive. We know that impulses are structured by five sub-waves, so more weakness is expected after a minor pull-back, ideally from 1565.

Our downside price objective is at 1530/1520; September lows.

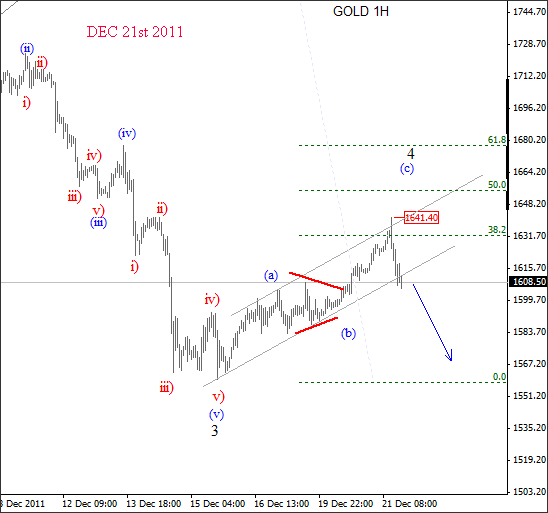

And below is a short description that our subscribers received on Dec 21st 2011:

- Gold reversed nicely in the past few sessions, in-line with our expectations, from around 1640 area. A minor fall from the top has an impulsive shape, so we think that top is in and that prices should move lower, especially as market is already trying to break out the support channel line. But to get even more sure about the “top in place”, you may also wait on a daily close price action. But in either case, if wave 4 done, then we don’t want to see price back above 1642.

If you want more similar technical analysis and opportunities, then now its your time to take advantage of our special Holiday offer, GET 2 MONTHS FOR PRICE OF 1! Click here

Twitter Updates