The Australian dollar climbed as today’s report showed that confidence of Australian consumers rose and tomorrow’s data about employment is expect to demonstrate an improvement. The euro managed to outperform the currency of Australia. The Westpac Melbourne Institute Index of Consumer Sentiment increased by 2.4 percent in January after it dropped by 8.3 percent in December. The report of the Australian Bureau of Statistics is expected to show that Australian employers added 10,300 jobs last month. … “Australian Dollar Higher as Consumer Confidence & Employment Improve”

Month: January 2012

NZD/USD: Trading the New Zealand CPI January 2012

The New Zealand CPI (Consumer Price Index), which is released every quarter, measures the change in the price of goods and services charged to consumers. The index is often a market-mover, and a reading which is higher than the market forecast is bullish for the New Zealand dollar. Here are all the details, and 5 possible outcomes for NZD/USD. … “NZD/USD: Trading the New Zealand CPI January 2012”

US Dollar Falls after Upbeat News

US dollar is falling today, thanks to upbeat news out of China and Europe. With risk appetite on the rise, there is little demand for the safety and stability of the US dollar. Forex traders are, instead, turning to higher yielding currencies. US dollar is dropping as confidence makes an appearance in the markets. Germany’s ZEW data surprised quite a bit to the upside. On top of that, borrowing costs dropped in Spain and Greece. This good … “US Dollar Falls after Upbeat News”

Mexican Peso Climbs to Monthly High

The Mexican peso reached today the highest level in more than a month as Forex market participants ignored rating downgrades by Standard & Poor’s, supporting demand for currencies of emerging economies. S&P performed downgrades for credit ratings of several European countries on January 13, including a two-notch cut for Spain. Despite the negative news, yield on Spanish debt dropped to average 2.049 percent at today’s auction, compared with 4.05 percent on December 13. … “Mexican Peso Climbs to Monthly High”

Brazilian Real Goes Higher as GDP in China Slows

The Brazilian real climbed today after a report about slowing economic growth in China lead to speculation that the Asian nation will stimulate its economy, increasing attractiveness of commodity currencies. China’s gross domestic product growth slowed from 9.1 percent in third quarter of 2011 to 8.9 percent in the fourth quarter. That caused market experts to speculate about possible stimulating measures to support growth of the economy. Potential stimulus is … “Brazilian Real Goes Higher as GDP in China Slows”

Euro Gains as Borrowing Costs Drop

Euro is gaining in Forex trading today, with a measure of optimism returning as Greek and Spanish borrowing costs drop. Also helping the euro is the good news coming out of Germany, with a better than expected ZEW. After selling off so much recently, it appears that the euro is due boost. Forex traders appear ready for risk, with better news out of the eurozone, as well as improved Chinese … “Euro Gains as Borrowing Costs Drop”

FxPro Trading Volume Rises by 11% in 2011

Forex broker FxPro enjoyed a strong 2011 with trading volume up by 11% to $1.18 trillion. Q4 saw a return to normal after a strong Q3. Trade from Asia became an absolute majority, surpassing the 50% mark. This is significantly higher than 2010. Revenue per million traded slid to $71.4, down from $75. The most … “FxPro Trading Volume Rises by 11% in 2011”

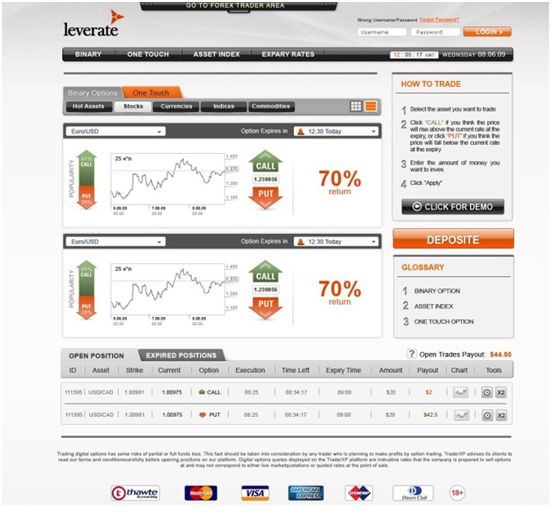

CySEC License Obtained by PIM Prime Investments (Leverate)

PIM Prime Investments Ltd. a subsidiary of Leverate rerceived an official licence from CySEC, the regulatory body in Cyprus. Leverate provides software solutions for brokers. The move continues the expansion of Leverate, which is partially owned by Saxo Bank. The firm recently opened datacenters in London. For more details about this licence, the full press release is … “CySEC License Obtained by PIM Prime Investments (Leverate)”

French and German Pension Liabilities – 3 Times GDP

With peripheral countries facing tough bond payments every month, it’s too easy to miss the longer term – the retirement. France and Germany have big liabilities, reaching 3 times their GDP. This is a time bomb with a large fuse, but it’s out there. According to a research by the Research Center for Generational Contract in Freiburg … “French and German Pension Liabilities – 3 Times GDP”

Get Ready For Stock Market Collapse In 2012

A fall from 2007 down to 2009 March lows unfolded clearly in impulsive structure, which we know is indication of a trend. As such, we are very confident that larger trend has now turned down, especially after only 3-waves of recovery into 1370 region; exactly for 78.6% retracement of previous impulsive fall! In fact, even … “Get Ready For Stock Market Collapse In 2012”