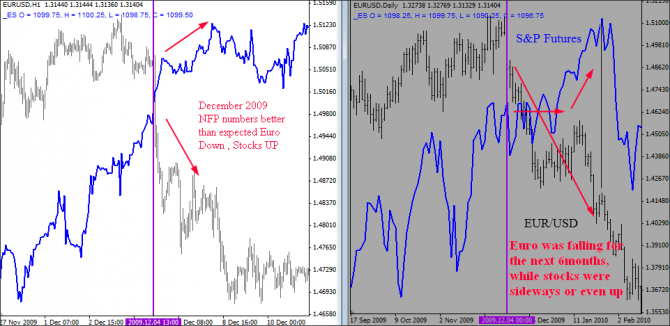

A quick look into the NFP numbers from December 2009 revels an interesting pattern. At that time expectation was for loss 120K jobs but number came out a loss only of 11K. This result was far better than expected and euro fell sharply while stocks rallied. This is the same reaction that we see today. In fact, I have an overlay chart from that time. You will notice that stocks then moved sideways or even up, while the euro was falling sharply for the next 6 monhts.

Will history repeat itself!? You can ignore it or you may not. But my charts today are telling me »Don’t Buy Euro«, and »We are Too High to Invest in Stocks«!

Euro –S&P relationship in Dec 2009 and later

EUR/USD vs SP Dec 2009 – Click image to enlarge

Do you like analysis? You want to get something simmilar more often? Join us now at www.ew-forecast.com

March 2012

EUR/USD vs S&P 2012 – Click image to enlarge

Guest post by Gregor Horvat