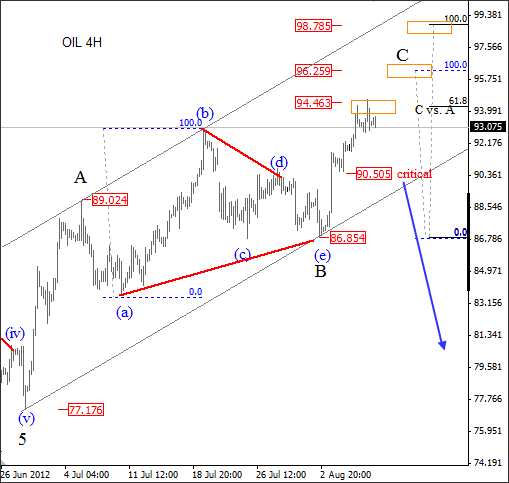

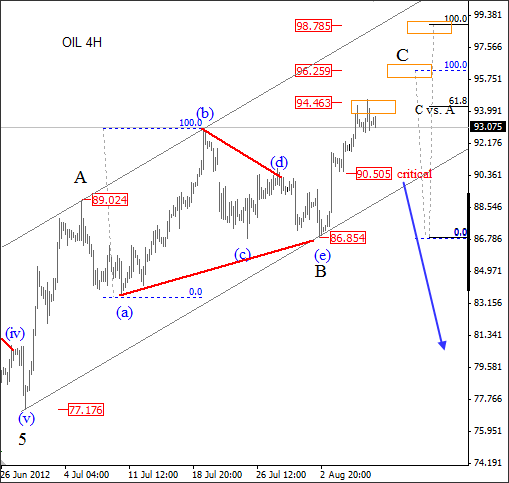

On crude oil we are observing a corrective rally, which means that larger downtrend, started back in March 2012 remains in play. The price structure is showing a three wave movement from the low of 77 with a running triangle in wave B.

Keep in mind that breakouts of a triangles are terminal. So, if we are correct, then current strength is wave C is a final leg of a recovery, that already reached first resistance around 94.40. We may see even extensions to 96 or even 99 based on Fibonacci projections, which however may not get hit if market reverses lower in impulsive fashion.

Crude Oil Elliott Wave Technical Analysis – Click image to enlarge

Guest post by Gregor Horvat

So. all the focus should now be on any larger decline. Because if this fall will unfold in five waves, let’s say back below $90.50 per barrel, then we will call and confirm a tradeable top of a C wave and will focus on larger downtrend continuation. Remember, let the price confirm your wave count!

Also keep in mind that fall on Crude Oil and other risky assets will be bearish for EUR and more importantly bullish for USD.

New members take advantage of a special Offer now: 7day trial