Spain will likely submit a formal aid request during August, and this will open the door for ECB help. However, Spain doesn’t have any more planned bond auctions during this month, and could take its time, before a showdown in September. If Spain takes its time, this could be very problematic, as the country already … “Spain: Money Leaves and Internal Tension Mounts”

Month: August 2012

Loonie Gets Boost from Carney’s Comments

The Canadian dollar gained today, rising for the fifth straight trading session against the US dollar, as Mark Carney, Bank of Canada’s Governor, suggested that an increase of interest rates may be needed in the near future. The Canadian economy differs from the struggling economies of some other developed nations, which strives to lower their borrowing costs. Carney said today in an interview: We had been growing above trend, and the extent to which … “Loonie Gets Boost from Carney’s Comments”

Uncertainty Sends Euro Lower

Uncertainty about the fate of the eurozone is once again front and center in the markets, and that is sending the euro lower. The ECB has failed to act as quickly as many would like, and disappointing German data is dragging on the 17-nation currency. Once again, eurozone leaders have disappointed Forex traders and the markets. After promising to do anything to save the euro, Mario Draghi and the ECB have failed to act. This is disappointing many, … “Uncertainty Sends Euro Lower”

US Dollar Surges Ahead After Economic Data

US dollar is heading higher today, surging ahead of its high beta counterparts as improved economic data is reported, and as risk appetite flees in the wake of disappointed ECB hopes. Greenback has the upper hand today against high beta currencies as the situation becomes more interesting. Hopes about action from Mario Draghi and the ECB are starting to fade. It seems clear that no one in the eurozone is … “US Dollar Surges Ahead After Economic Data”

Yen Advances as BoJ Refrains from Stimulus

The Japanese yen advanced today after the Bank of Japan refrained from stimulating the nation’s economy and left its monetary policy unchanged. Earlier, the currency weakened as the Asian stocks rallied, reducing demand for the safety of yen. The BoJ kept its main interest rate near zero and the size asset purchases at 45 trillion yen, while the lending fund remained at 25 trillion yen. The bank said in the statement that “Japan’s economic activity … “Yen Advances as BoJ Refrains from Stimulus”

FXCM Q2 Results: Sees Record Client Equity, Drop in

US based Forex Broker FXCM reported the results for the second quarter of 2012. Client equity rose by 20% from the end of 2011 to over $1.2 billion in Q2. On the other hand, revenue fell by 11% in comparison to Q2 2011. The company also reported operating metrics for July 2012, which saw a … “FXCM Q2 Results: Sees Record Client Equity, Drop in”

USD/CAD: Trading the Canadian Jobs Aug 2012

The Canadian employment change is an important leading indicator which can have a significant impact on the markets. An unexpected reading in this key release can affect the direction of USD/CAD. A reading higher than forecast is bullish for the loonie. Here are the details and 5 possible outcomes for USD/CAD. Published on Friday at 12:30 GMT. Indicator Background Job … “USD/CAD: Trading the Canadian Jobs Aug 2012”

AUD/NZD Jumps as Australian Employment Improves

The Australian dollar gained against its New Zealand peer as employment data in Australia was better than expected, while employment in New Zealand disappointed Forex market participants who expected an improvement of New Zealand’s labor market. Australian employment added 14,000 jobs in the period from June to July, following the drop by 28,300 in the previous period. The unemployment rate was at 5.2 percent last month, while the June’s figure was … “AUD/NZD Jumps as Australian Employment Improves”

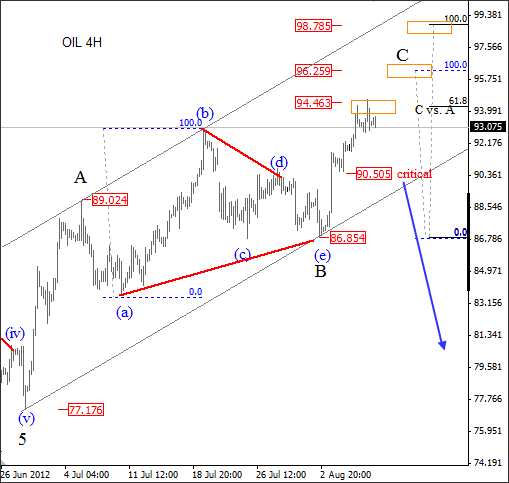

Crude Oil: The Rally Is Corrective

On crude oil we are observing a corrective rally, which means that larger downtrend, started back in March 2012 remains in play. The price structure is showing a three wave movement from the low of 77 with a running triangle in wave B. Keep in mind that breakouts of a triangles are terminal. So, if … “Crude Oil: The Rally Is Corrective”

NZ Dollar Suffers from Bad Employment Data

The New Zealand dollar weakened today after the bad employment data showed that optimistic expectations of analysts were totally unwarranted. The negative report sapped strength from the currency that was already weakening. Experts promised that employment in New Zealand would grow and the unemployment rate would fall. The reality was nowhere near the optimistic predictions. Employment fell by 2,000 jobs (0.1 percent) in the second quarter of this year. … “NZ Dollar Suffers from Bad Employment Data”