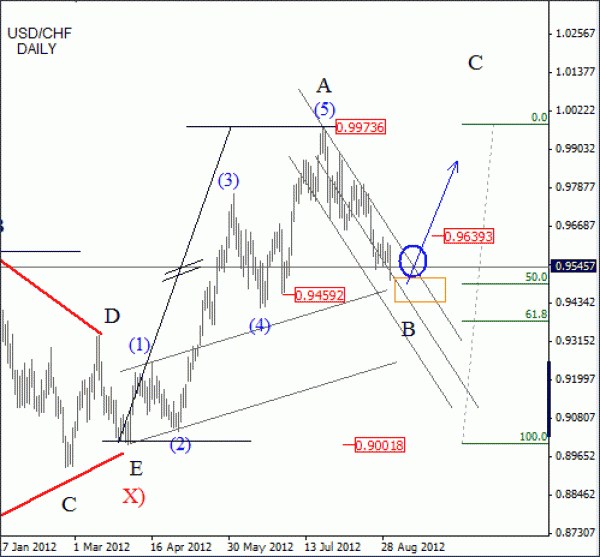

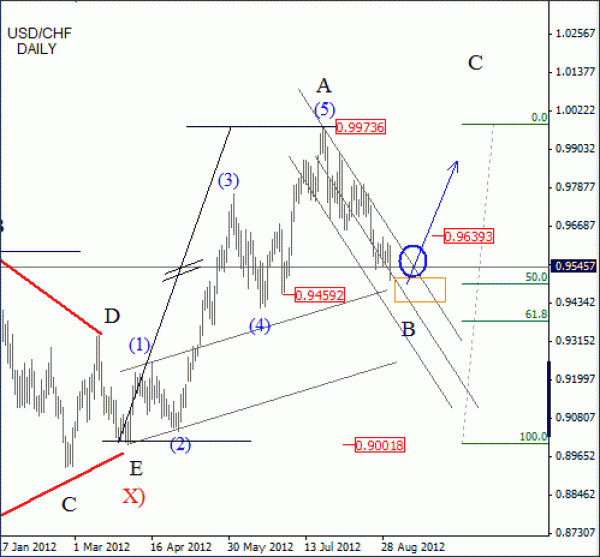

USDCHF was trading lower during August: from the 0.9970 high, where we believe that wave A, part of a second larger zig-zag, found the peak. If that is the case, we know that the sell-off from that latest high must be a corrective move.

Well, if we take a look on the substructure of a current decline, which is very choppy and overlapping, then we definitely must be prepared for an uptrend continuation.

USD CHF Elliott Wave Analysis – Click image to enlarge

Guest post by Gregor Horvat, Chief Technical Strategist at EW Forecast.

But that’s not all. Notice that the pair is trading very closely to previous wave (4) of one lesser degree where important turning points usually occur. However, we still need some kind of an upward reaction before we may look for a push towards parity. An impulse rally back to 0.9700 will argue that wave B bottom was found.

New members take advantage of a special Offer now: 2 Months For Price Of 1

Follow Gregor on Twitter: