Switzerland reported a disappointing GDP report for Q2: the economy squeezed by 0.1% instead of growing by 0.2% as expected. In addition, growth in Q1 was revised to the downside: 0.5% instead of 0.7% originally reported, making the Q2 figure even smaller. On this background, the Swiss National Bank will likely keep the floor under … “EUR/CHF Peg Here to Stay”

Month: September 2012

AUD/USD: Trading the Australian GDP Sep 2012

Australian Gross Domestic Product (GDP) measures the production and growth of the economy. It is considered by analysts as one the most important indicators of economic activity. A GDP reading which is higher than forecast by the markets is bullish for the Australian dollar. Here are all the details, and 5 possible outcomes for AUD/USD. … “AUD/USD: Trading the Australian GDP Sep 2012”

Important Week for Dollar: US Employment Data & ECB Policy Decision

The season of vacations has ended and Forex market trading should become more active. Traders face rather busy first week of autumn as many central banks will announce their rate decision. What can be expected for the dollar during the trading week? Federal Reserve Chairman Ben Bernanke drove the US currency lower last week, giving hints that the third round of quantitative easing is possible. The Fed … “Important Week for Dollar: US Employment Data & ECB Policy Decision”

Euro Gains Slightly, But Remains Vulnerable

Euro is seeing slight gains today, heading a little higher against the US dollar. For now, the gains are somewhat limited, since trading is thin. With US markets closed for the Labor Day holiday, it is little surprise that most currencies are rangebound right now. Euro, though, is looking to eke out some gains today. Much of the euro’s strength today is coming from … “Euro Gains Slightly, But Remains Vulnerable”

Canadian Dollar Consolidates Last Week’s Gains

At the end of last week, the Canadian dollar posted its biggest gain since January, thanks in large part to the fact that Canada’s economy grew more than forecast for the second quarter. This pleasant surprise, along with demand for riskier assets and climbing oil prices, are boosting the loonie today. Today, there is a great deal of rangebound trading taking place. US markets are closed for the Labor Day holiday, … “Canadian Dollar Consolidates Last Week’s Gains”

USD/JPY: Trading the ISM Manufacturing PMI Sep 2012

The ISM Manufacturing PMI (Purchasing Managers’ Index) is based on a survey of purchasing managers in the manufacturing sector. Respondents are surveyed for their view of the economy and business conditions in the US. A reading which is higher than the market forecast is bullish for the dollar. Here are all the details, and 5 … “USD/JPY: Trading the ISM Manufacturing PMI Sep 2012”

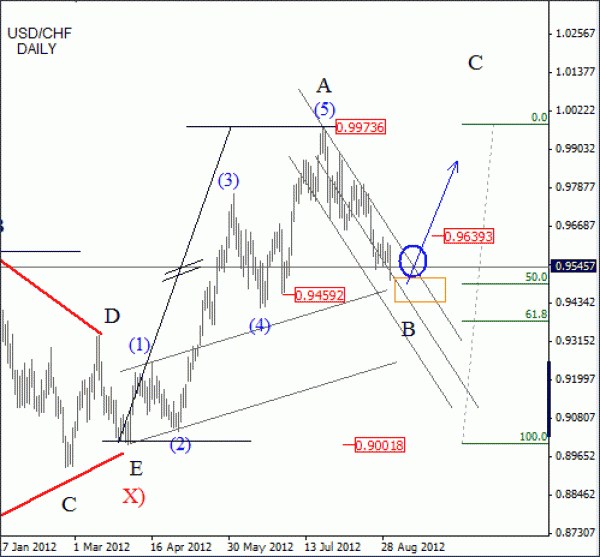

USD/CHF Elliott Wave: Patiently Waiting For Bullish Price Action

USDCHF was trading lower during August: from the 0.9970 high, where we believe that wave A, part of a second larger zig-zag, found the peak. If that is the case, we know that the sell-off from that latest high must be a corrective move. Well, if we take a look on the substructure of a … “USD/CHF Elliott Wave: Patiently Waiting For Bullish Price Action”

Forex Crunch Key Metrics August 2012

The vacation month of August saw a slide in page views, but a rise in visits and visitors. The end of the vacation season and the busy calendar in September raise the chances of a strong September. As during all the months of 2012 so far, also August 2012 was better than August 2011. Here … “Forex Crunch Key Metrics August 2012”

GBP/USD: Trading the British Manufacturing PMI

British Manufacturing PMI is based on a survey of Purchasing Managers in the manufacturing sector. Respondents are surveyed for their views on a wide range of business conditions, including employment, new orders, prices and inventories. A reading which is higher than the market forecast is bullish for the pound. Here are all the details, and 5 possible outcomes for … “GBP/USD: Trading the British Manufacturing PMI”

Another Weekly Loss of US Dollar, Decline Can Still Be Reversed

Currencies’ movements were driven by two major themes this week: the speech of Federal Reserve Chairman Ben Bernanke at the Jackson Hole Symposium and the bailout for Spain. The US dollar ended with yet another weekly loss by the weekend, but further decline is by no mean guaranteed. Bernanke has given hints about the second round of the quantitative easing program at Jackson Hole in 2010 and Forex market participants hoped that he … “Another Weekly Loss of US Dollar, Decline Can Still Be Reversed”