The ISM Manufacturing PMI (Purchasing Managers’ Index) is based on a survey of purchasing managers in the manufacturing sector. Respondents are surveyed for their view of the economy and business conditions in the US. A reading which is higher than the market forecast is bullish for the dollar. Here are all the details, and 5 … “USD/JPY: Trading the ISM Manufacturing PMI Nov 2012”

Month: October 2012

Pound Retains Gains as SNB Boosts Its Foreign Reserves Holdings

The Great Britain continued to rise today on speculations that the Bank of England will refrain from adding stimulus. The Swiss National Bank added to its holding of the sterling, further increasing the appeal of the currency. The BoE policy makers voted unanimously for keeping monetary policy unchanged on the last meeting. Fundamental data, that has been received since then, do not suggest that the bank’s officials should change their stance during … “Pound Retains Gains as SNB Boosts Its Foreign Reserves Holdings”

Krone Rises as Norges Bank Does Not Plan to Buy Foreign Currency

The Norwegian krone climbed today as Norway’s central bank indicated that it is not going to buy foreign currency for the government fund. On the negative side, unemployment growth stalled in August. The Norges Bank indicated that it is not going to buy foreign currency for the Government Pension Fund Global in November. The central bank said: Norges Bank has increased the size of the petrobuffer portfolio considerably through 2012 for covering the transfers … “Krone Rises as Norges Bank Does Not Plan to Buy Foreign Currency”

The calm between storms

The US Presidential Elections are likely to shake all currencies. The Australian dollar is set to make larger moves, especially if the result is not favorable for addressing the fiscal cliff, says Michael Derks of FxPro. In the interview below, Derks also discusses the inevitability of a Spanish bailout, the situation in Greece, the “transitional” … “The calm between storms”

Euro Gets Boost on Improved Risk Appetite

Euro is getting a boost today on improved risk appetite. Even though the situation in the eurozone continues to be one of uncertainty and economic difficulty, the euro is gaining ground today. Once again, general risk appetite is helping the euro, along with other high beta currencies. Even though the eurozone economic situation continues to show signs of deterioration, the 17-nation currency has the upper hand today. For another month, the unemployment … “Euro Gets Boost on Improved Risk Appetite”

Canadian Dollar Slips after Advancing Earlier

Canadian dollar is slipping right now, following an earlier advancement. Trading has been somewhat choppy for the loonie in recent days, and now the currency is back below parity with the US dollar, and slipping against other majors as well. Earlier this week, the loonie slipped below parity on concerns about oil, as well as Hurricane Sandy. However, things seemed to turn around after manufacturers’ prices rose, and with US … “Canadian Dollar Slips after Advancing Earlier”

Forex Magnates Summit – MarketsPulse to Attend

The Forex Magnates is getting closer. As November 14th approaches, MarketsPulse, a binary options provider has announced it will attend the event. No less that 350 top executives will convene in London and the growing binary options segment will definitely be on the agenda. LONDON–Executives from MarketsPulse, the world leaders in enterprise binary options solutions, … “Forex Magnates Summit – MarketsPulse to Attend”

Retail Sales Far Better Than Expected, Boosting Pound

The Great Britain pound was stronger after retail sales report, that was far better than anticipated, spurred speculations that the Bank of England may refrain from boosting its asset purchase program. The currency remained weak versus the euro. Confederation of British Industry released its Distributive Trades Survey, which showed a positive balance of 30 in October. That was the highest reading since June and twice the expected … “Retail Sales Far Better Than Expected, Boosting Pound”

Dollar Retreats as Risk Aversion Recedes

The US dollar fell today, following yesterday’s gains on risk aversion. Today, traders were a bit more courageous after Hurricane Sandy hit the United States and damage was assessed. Positive US fundamental data also dampened need for safer assets. Sandy made a landfall and some experts speculated that damage was smaller than was expected. Market participants anticipated more severe consequences and now are selling … “Dollar Retreats as Risk Aversion Recedes”

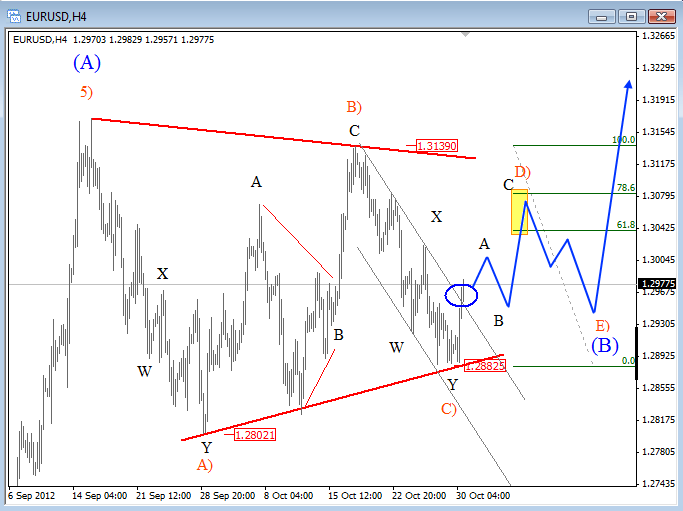

EURUSD: Triangle Within A Bullish Trend (Elliott Wave)

Markets are slow and choppy for some time now, and with low liquidity (due to the closure of the US equity market) we think that EURUSD will not break out of this range so soon. But when it will, this will most likely be to the upside, if we consider that pair has turned bullish … “EURUSD: Triangle Within A Bullish Trend (Elliott Wave)”